100 Stories2012, a large-scale M&A, acquisition of ZOLL Medical

In 2012 Asahi Kasei conducted its largest M&A. ZOLL Medical, a major U.S. manufacturer of critical care devices and systems, was acquired.

In the five-year strategic management initiative, “For Tomorrow 2015”, Asahi Kasei launched a project for creating new businesses in health care focusing on three areas of critical care, at-home care using IT, and cell culturing/regenerative medicine.

The acquisition of ZOLL enabled Asahi Kasei to obtain a business platform for critical care business. Taketsugu Fujiwara, President of Asahi Kasei at the time, mentioned that the acquisition was the largest Asahi Kasei had ever had with its amount being one or two digits higher than previous ones, totaling around ¥181.7 billion at the exchange rate at that time, showing Asahi Kasei’s resolve to make it a future pillar of business meeting the world’s needs.

A NASDAQ stock exchange listed company, ZOLL was founded in 1980. Its revenue was approximately ¥43.7 billion and operating income ¥4 billion in the fiscal year ending in September 2011. A medical device manufacturer specialized in critical care centered on resuscitation, ZOLL’s CAGR reached 16% between fiscal years 2001 and 2011.

ZOLL is the leading U.S. supplier of defibrillators for hospitals and emergency medical services, having a share over one third. Its Thermogard body temperature cooling device recorded sales of around ¥2.2 billion in 2011. Along with the ability to develop such “only-one” products, ZOLL has a network of academic and medical institutions cultivated through its products’ sales.

According to Fujiwara, “Asahi Kasei decided to acquire ZOLL, having a dominant presence and firm business platform in the critical care market in the U.S., to promptly establish the needed foundation for the critical care business.”

ZOLL also gained advantages by joining the Asahi Kasei Group as Richard Packer, CEO of ZOLL, commented, “Asahi Kasei not only gave us the resources we needed when we needed them, but they gave us the freedom to operate the ZOLL way and never pushed us to operate in their way. It was extraordinary for an U.S. company on the scale of $500 million to continue to thrive under a Japanese company.”

At the time of the acquisition, Fujiwara said he wanted Packer to do what was best for ZOLL, and Asahi Kasei would respect that. Fujiwara believes a big factor in ZOLL’s continuing growth was that he told Packer this philosophy for operating ZOLL within the Asahi Kasei Group, and this philosophy has been followed.

Asahi Kasei had targeted ¥2,000 billion of net sales and ¥200 billion of operating income by around 2016, which were more than could not be achieved by organic growth alone. Asahi Kasei executed a large-scale M&A for the first time with ZOLL.

The day after Asahi Kasei announced its decision to acquire ZOLL, its share price fell by 6% as it seemed like a big investment in an unrelated business. However, ZOLL continues to grow as a major pillar of the Asahi Kasei Group’s Health Care sector. The acquisition of ZOLL marked a milestone for Asahi Kasei to accelerate its M&A strategy, and large-scale acquisitions followed such as Polypore, Sage, and Veloxis.

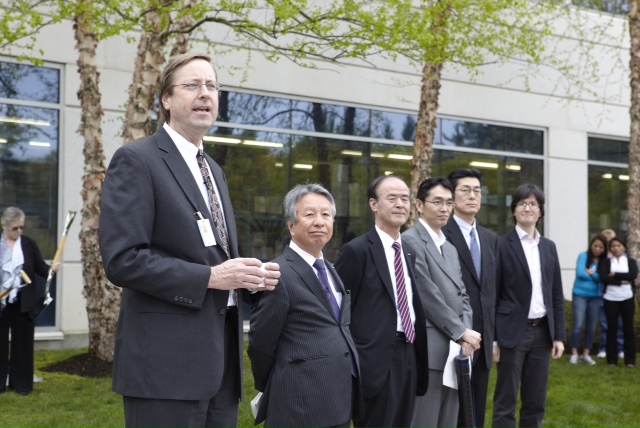

Speaking to employees gathered in front of the ZOLL headquarters on May 10, 2012

Speaking to employees gathered in front of the ZOLL headquarters on May 10, 2012