100 Stories1990 Global front-runner acrylonitrile business

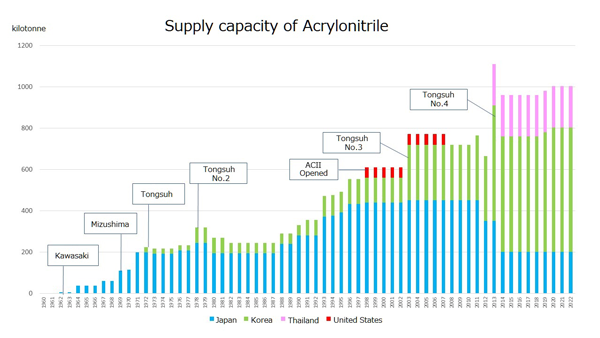

Asahi Kasei's acrylonitrile (AN) business, which boasts the largest annual production capacity in Asia and the second largest in the world, is expanding its market worldwide.

Asahi Kasei's AN business began in 1960 with a license agreement with Sohio Corporation. However, the technology exchange agreement expired in 1977, and the two companies went their separate ways in catalyst development and other areas. However, the perpetual confidentiality agreement included in the original contract continued to be a stumbling block to Asahi Kasei's overseas expansion.

Signs of change began to appear ten years later, in 1987, when Sohio was to be merged into BP of the UK. BP used the merger as an opportunity to focus attention on Asahi Kasei's catalyst technology, which had achieved a 5% higher AN yield than its own catalysts. After two years of negotiations, an agreement between Asahi Kasei and BP's U.S. subsidiary, BP Chemicals, was signed in 1990.

The agreement was a license agreement that allowed BP to manufacture, use, and sell the Asahi catalyst, but for Asahi Kasei, it meant the removal of a long-sought permanent confidentiality agreement. This was a strong statement of intent from Miyazaki (who was chairman at the time) as well as the efforts of the employees involved in the negotiations and the high regard in which they held Asahi catalyst. All of these factors contributed to the successful conclusion of the negotiations. With the confidentiality obligation removed, Asahi Kasei shifted to a global sales strategy.

In 1994, the Organic Raw Materials Division was established, and three monomer businesses (AN, styrene monomer, and methyl methacrylate(MMA)) were incorporated simultaneously. The company shifted its focus from self-supply to external sales, particularly in the East Asian market, with the goal of becoming the world's No. 1 supplier of AN to the global market.

In fact, the fiber and resin businesses (the main applications for AN at the time), had reached a plateau in Japan, and since fiber is a labor-intensive industry and labor costs account for a large proportion of costs, the manufacturing base shifted to Asia, especially China, where labor costs are low. The international demand structure was changing as demand for ABS resin grew dramatically in South Korea and Taiwan.

Acrylic fiber manufacturers often procure AN in-house, while few ABS resin companies manufacture their own AN. Asahi Kasei's strategy was to enter China and become the No. 1 supplier among the other top Asian companies that did not have AN plants.

In addition, with the development of Asia, the number of independent companies that do not have AN plants is increasing in the textile industry. Unlike other domestic companies, Asahi Kasei, whose confidentiality agreement with BP had been terminated, had the freedom to expand overseas, and with the Asahi catalyst as a major weapon, it was in an advantageous position to compete with European firms. Asahi Kasei decided that it was a growth industry from a global perspective, and started down the path of global expansion.

Kenichi Shibukawa, General Manager of the Organic Raw Materials Division, had the following to say about the company's global expansion.

The four growth markets are Latin America, the Middle East, Africa, and South Asia, ASEAN, and Korea, Taiwan, and China. In these regions, there is a large regional demand gap, but production capacity has barely increased in relation to the growth in demand. In order to strengthen sales in these growth markets, we would like to establish a market-specific production system, or what we call a global operation system.

The AN business had potential, but was hamstrung. However, Asahi Kasei was determined to take advantage of the opportunity, and once it did, it set its sights on a major goal.