Asahi Kasei is often said to have a “goby fish” style of management. People are poking fun at us by comparing our business diversification to a goby fish that will try to eat anything. While this may be funny, it’s not based on a true understanding of our business. Asahi Kasei certainly makes a diverse range of products; even I can’t remember them all. We have not only synthetic fiber, synthetic resin, and synthetic rubber, but also foods, pharmaceuticals, and medical devices, and even housing and construction materials. You could say we cover the basic human needs of food, clothing, and shelter.

On the surface, it may seem strange for a fiber company to make such dissimilar products as hamburgers, anticancer drugs, and artificial kidneys. But with the exception of housing and construction materials, there is a thread that connects them all together. We didn’t just jump into all these areas haphazardly.

Asahi Kasei started out as a subsidiary of Japan Nitrogenous Fertilizer Company in order to make effective use of the ammonia synthesis business started by Mr. Shitagau Noguchi. So the core technology is related to ammonia.

Bemberg, which has long been a mainstay of Asahi Kasei, is produced by using ammonia solution to dissolve cotton linter. When we started producing caustic soda by salt electrolysis as a way to effectively use surplus electricity from our power plants, we commercialized the condiment monosodium glutamate by using chlorine produced when making the caustic soda.

Later we began making monosodium glutamate by fermentation, and the fermentation technology allowed us to make drugs. We developed artificial kidneys by using hollow fibers made from Bemberg.

So all these seemingly unrelated businesses are actually connected organically. Our accumulation of technology is what led to the Asahi Kasei of today. We aren’t really like a goby fish after all.

On the other hand, maybe the reason Asahi Kasei didn’t grow bigger is because we always stuck to applications of our technology. Although we have launched several businesses since I became President, we still haven’t ventured far beyond the range I inherited from my predecessors.

Thirty years ago, Matsushita Electric Industrial Co., Ltd. and Asahi Kasei had roughly the same sales and profits, but now we are far behind them. It’s because Konosuke Matsushita is a bold leader who proactively went into new areas starting from scratch.

In contrast, I built on the existing foundations I inherited from my predecessors, and didn’t actively dive into unknown territory. That’s the difference between our companies. Matsushita actually has the “goby fish” style of management in a good sense.

Nevertheless, I actively sought to diversify by applying existing technology. I didn’t think the company could develop if we just stuck to fibers.

We have to accept losses temporarily when starting a new business, because substantial investments are required for R&D, plant construction, and market development. I’ve always said that a company should have some divisions making “healthy losses” because the company is energized by efforts to turn loss-making divisions profitable. Asahi Kasei has always had some loss-making divisions.

There are two criteria for considering a loss to be healthy. One is that the business has prospects to become profitable in the future. The other is that the company has the capacity to endure the losses until then.

It takes skill and effort on the part of management to discern whether a business has future prospects. At least I have always made my best effort.

Some companies have a so-called “bonsai” style of management, with a compact business, little debt, and a high equity ratio. It may be fine for them, but I don’t choose that way. I think a company should have ample financial capacity, and it’s also important to have some hidden potential.

The new gift boxes composed Asahi-aji™ and Mitas™

The new gift boxes composed Asahi-aji™ and Mitas™

for umami seasoning, 1963.

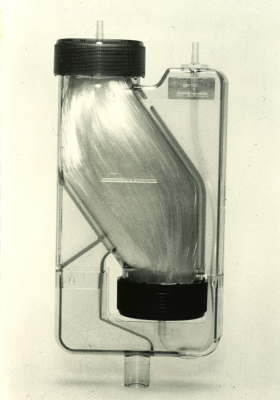

Artificial kidney using Bemberg™

Artificial kidney using Bemberg™

hollow fiber.