In the fall of 1981, when we were in the final stages of negotiations to buy the shares of Asahi Breweries, I started working on another major project: the Asahi-Dow merger. Asahi-Dow was the 50-50 joint venture with Dow Chemical we established in July 1952. Over the course of 3 decades, it had expanded into a variety of petrochemical products such as polyethylene and become a highly profitable maker of derivatives.

In the last few years, though, Asahi-Dow began showing signs of independence, such as trying to procure raw materials from outside the Asahi Kasei Group. But Asahi-Dow had in effect been a member of the Asahi Kasei Group as a part of our integrated production system from the naphtha cracker to derivatives.

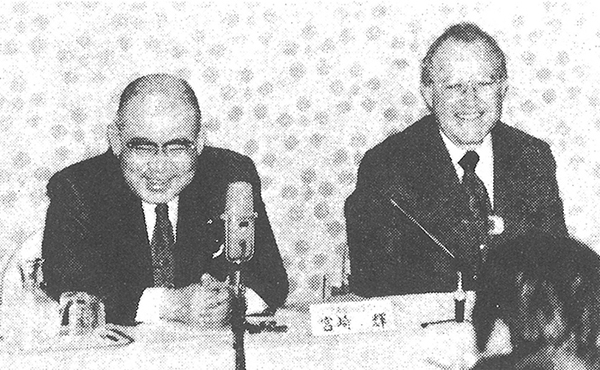

The Asahi-Dow merger press conference, the author (left) and

The Asahi-Dow merger press conference, the author (left) and

G. R. Baker, CEO of Dow Chemical Japan

Raw materials are supplied through pipelines connected between the plants, and the personnel hired by Asahi Kasei. Asahi-Dow only became successful with the tangible and intangible support of the Asahi Kasei Group. But the operating conditions for the petrochemical industry were becoming increasingly severe due to the long recession. Asahi Kasei needed to get this business back into shape quickly, including the issue of what to do with Asahi-Dow.

Dow Chemical proposed splitting Asahi-Dow into two parts, but this didn’t seem possible to me. I felt that the negotiations would go nowhere and we would have to take full ownership of the company. I visited Dow Chemical in the US in February 1982 to discuss the future of Asahi-Dow, and once again realized how difficult it is to manage an equally held joint venture.

The negotiations with Dow Chemical dragged on and on. On the sixth day we reached basic agreement for Asahi Kasei to acquire all the shares of Asahi-Dow, provided that the business of Styrofoam™ expanded polystyrene for thermal insulation would be transferred the Japanese subsidiary of Dow Chemical. After that there was quite a lot of intense negotiation until the contract was signed. Yumikura, our lead negotiator, had a tough time because the other side was pushing hard to get the highest price possible.

Dow Chemical seemed to be pulling out of overseas projects due to internal circumstances. They also withdrew from South Korea, Saudi Arabia, and Australia around the same time. Since Asahi-Dow was still profitable, they clearly wanted to sell as high as they could. But Asahi-Dow’s performance was rapidly deteriorating, so they wanted to sell their stake quickly before it got worse.

I expected that the negotiations would basically go well except for the matter of the price, which is just how it worked out. Unfortunately some of the managers at Asahi-Dow didn’t properly sense what was happening, and tried to go their own way. On June 1, 1982, we purchased Dow Chemical’s shares in Asahi-Dow for about 42 billion yen, raising our ownership to 100%. Asahi-Dow was then merged with Asahi Kasei on October 1.

Actually, Dow Chemical had asked us to sell them some of our Asahi-Dow shares 8 years earlier. They wanted to hold a majority of the shares so they could have the final say for managing Asahi-Dow. We turned them down, but I could see what they were thinking. It made me realize the difference between Japanese and American management styles. After that, I thought that we would have to clarify control of the business someday. Now that’s finally happened.

The merger with Asahi-Dow has been a success. We added products with high added value, and strengthened our constitution for more effective management, including integrated production and joint research.

Above all, the timing of the merger was right for Asahi Kasei. After that, we had to reorganize the petrochemical business, but we were in a stronger position to do so because of the merger.

Saran Wrap™ package, distributing

Saran Wrap™ package, distributing

by Asahi Dow