Medium-term Management Plan

In April 2025, the Asahi Kasei Group launched “Trailblaze Together” as a new medium-term management plan for fiscal 2025 to 2027. We will continue to evolve with “Diversity × Specialty” as our strength, gaining income growth by reaping returns from investment while raising capital efficiency through structural transformation and productivity improvement as we advance toward our vision for 2030. Our previous medium-term plan focused on transforming the business portfolio and reinforcing the management platform by implementing both investments for growth and structural transformation. Under the new plan, we aim for sustainable growth of corporate value not only by uniting the entire Asahi Kasei Group as a single team but also by promoting co-creation with various stakeholders including customers, other companies, and investors.

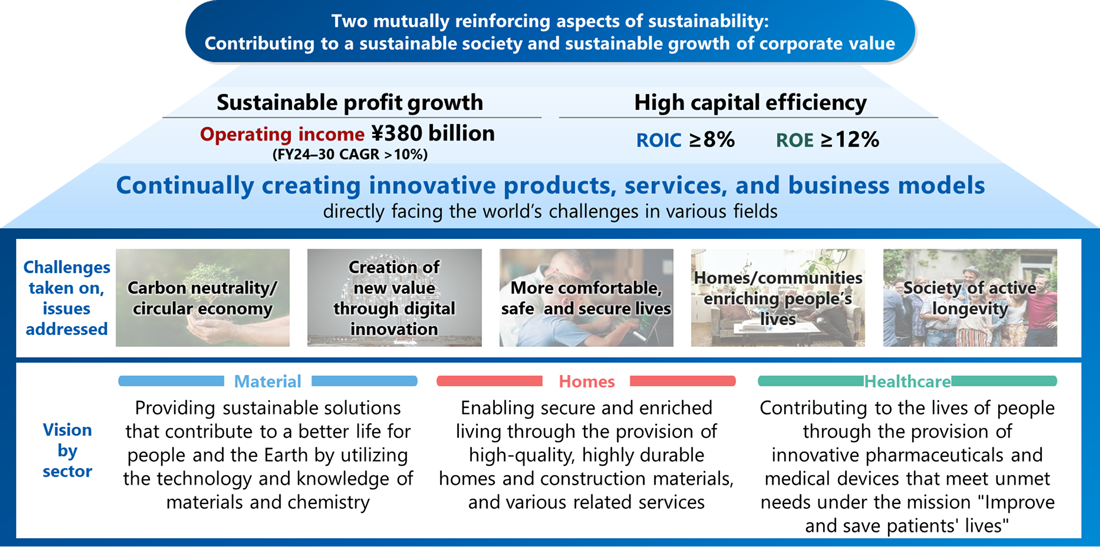

What we aim for in 2030

As the world’s challenges become more complex and intertwined across different industries, the Asahi Kasei Group will continue to create innovative products, services, and business models across the three business sectors of Material, Homes, and Healthcare. We will take on challenges and address issues in five key areas as we work toward operating income of ¥380 billion, ROIC of 8% or more, and ROE of 12% or more in fiscal 2030. Through such efforts we aim for two mutually reinforcing aspects of sustainability: contributing to a sustainable society and sustainable growth of corporate value.

Three basic policies

The medium-term management plan is focused on three basic policies:

- 1.Profit growth by generating returns from investments

- 2.Improving capital efficiency through structural transformation and enhanced productivity

- 3.Evolution of “Diversity × Specialty”

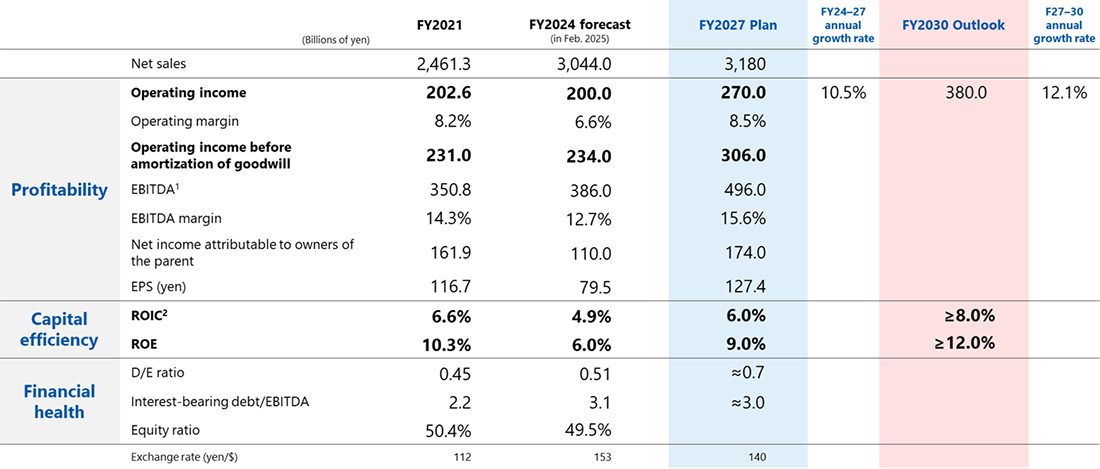

Our targets for fiscal 2027 are operating income of ¥270 billion, ROIC of 6.0%, and ROE of 9.0%.

Profit growth by generating returns from investments

We will leverage the business platform built through past M&A and growth investments to steadily generate profits. While continuing to invest in First Priority and Growth Potential businesses to drive profit growth, we will advance reforms in businesses identified for profitability improvement and business model change.

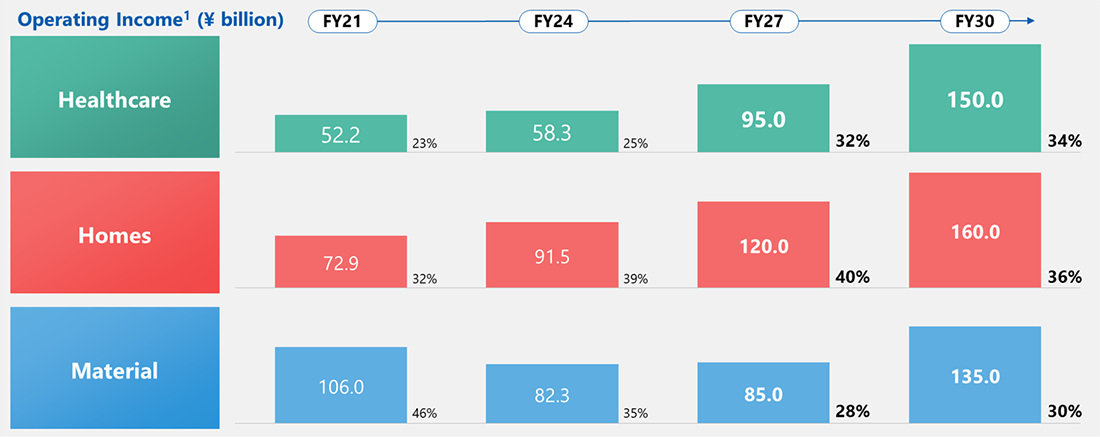

Financial outlook of businesses in each sector

1 Development business in real-estate (excl. rental and brokerage business) and land purchase/use in order-built homes

Improving capital efficiency through structural transformation and enhanced productivity

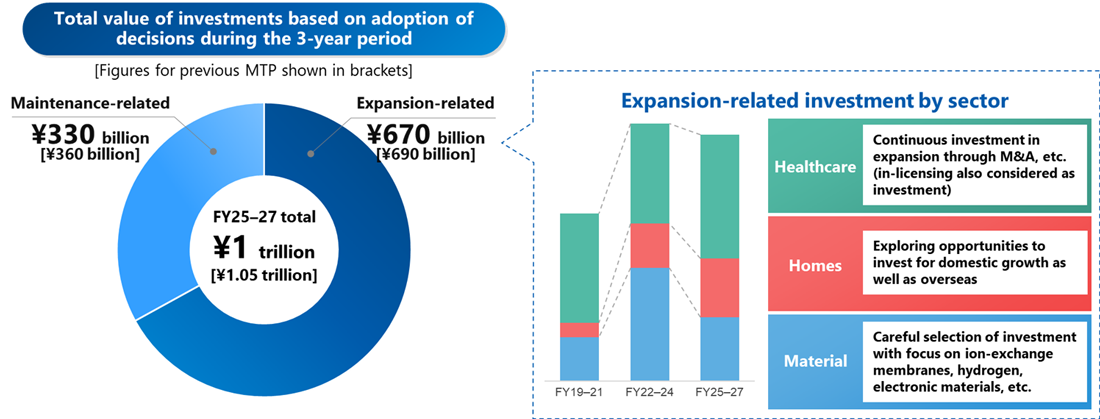

For businesses with low profitability and low capital efficiency, we will advance structural reforms and reconfigure business models to optimize capital allocation. In the Material sector in particular, we are advancing broad structural transformation centered on the Chemical domain through three approaches: 1) Structural reform from a best-owner perspective, 2) Optimization/reinforcement in concert with other companies, and 3) Autonomous structural transformation. Through these initiatives we aim to continuously improve ROIC and ROE.

We expect to adopt decisions on investments totaling approximately ¥1 trillion during the three years of the plan—roughly equivalent to the previous three-year plan. Of this, around ¥670 billion will be allocated to expansion-related investments. In addition to Healthcare, which we will continue to expand mainly through M&A, we will also explore growth investments in the Homes sector, both in Japan and overseas.

Evolution of “Diversity × Specialty”

We are shifting from an operating structure centered on the Material sector to a model in which high value-added businesses in diverse industries make greater contributions to income. Having built our management platform for over a century, we will leverage the diversity and uniqueness in three business sectors to foster a mutually reinforcing cycle of sustainable growth.

Income targets to fiscal 2030

1 Percentages by sector exclusive of "Others" category and corporate expenses and eliminations; figures for FY2024 are forecasts announced in February 2025

Management indicators

1 EBITDA = operating income + depreciation and amortization (tangible, intangible, and goodwill)

2 ROIC = (operating income − income taxes) ÷ average annual invested capital