Corporate Governance

As of June 25, 2025

Basic Approach

The Asahi Kasei Group Vision is to provide new value to society and solve social issues by enabling "living in health and comfort" and "harmony with the natural environment" under the Group Mission of "contributing to life and living for people around the world." With this as a base, the Company aims to contribute to society, achieve sustainable growth, and enhance corporate value over the medium to long term by promoting innovation and creating synergy through integration of various businesses. The Company continues to pursue optimal corporate governance as a framework to make transparent, fair, timely, decisive, and appropriate decision-making in accordance with changes in the business environment.

Basic Policies

1. Securing the Rights and Equal Treatment of Shareholders

While taking proper measures to secure shareholders' rights, the Company develops a proper environment for exercise of shareholders' rights including paying attention to foreign shareholders and minority shareholders and providing information necessary for the exercise of rights accurately and in a timely manner.

2. Proper Cooperation with Stakeholders other than Shareholders

The Group Vision of the Company is to provide new value to society and solve social issues by enabling "living in health and comfort" and "harmony with the natural environment" for people around the world, and the Company works to facilitate cooperation with its stakeholders.

3. Proper Information Disclosure and Securing of Transparency

The Company, in addition to disclosure required by laws and regulations, actively provides information to various stakeholders including financial information such as financial position and operating results, management strategy/issues, and non-financial information concerning risks and governance, etc.

4. Responsibilities of the Board of Directors

In order to achieve sustainable growth, enhance medium to long term corporate value, and increase earnings ability and capital efficiency, the Board of Directors of the Company presents the overall direction of its management strategy, develops an environment to support risk-taking by the management, and effectively oversees the business management of the Company from an independent and objective standpoint, based on the fiduciary responsibility and accountability to shareholders.

5. Dialog with Shareholders

The Company develops a system to have a constructive dialog with shareholders/investors and actively promotes such dialog.

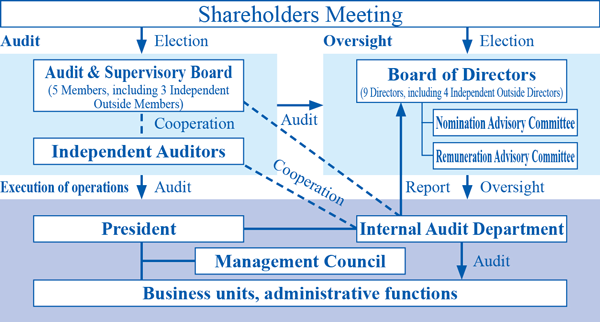

Corporate Governance Framework

Corporate governance configuration

Meetings of Board of Directors, Advisory Committees, and Audit & Supervisory Board (fiscal 2024)

| No. of meetings held | Average attendance | Main subjects of agenda | |

|---|---|---|---|

| Board of Directors | 15 | 99% (Directors and Audit & Supervisory Board Members) |

|

| Nomination Advisory Committee* | 8 | 100% (all members) |

|

| Remuneration Advisory Committee* | 6 | 100% (all members) |

|

| Audit & Supervisory Board | 33 | 99% (Audit & Supervisory Board Members) |

|

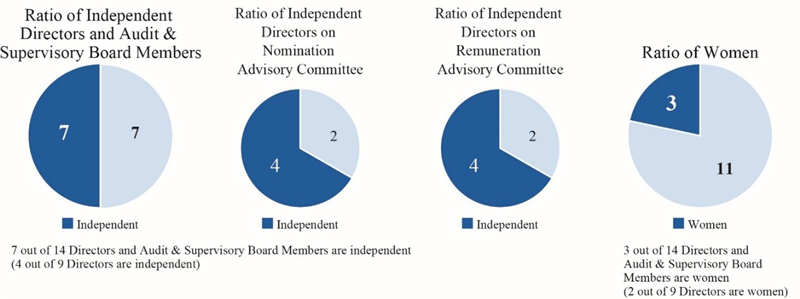

- * The Nomination Advisory Committee and Remuneration Advisory Committee are comprised of the 4 Outside Directors and Chairman & Director Hideki Kobori and President & Representative Director Koshiro Kudo as members, with the Nomination Advisory Committee chaired by Outside Director Tsuyoshi Okamoto and the Remuneration Advisory Committee chaired by Outside Director Yoshinori Yamashita.

Policy and Procedures to Nominate Candidates for Directors

In selecting candidates for Directors, the Company chooses persons with deep insight and excellent skills suitable for Directors. For inside Directors, the Company chooses those with expertise, experience and skills in the required field as candidates. Meanwhile, for Outside Directors, the Company chooses as candidates corporate executives, academic experts, and former civil servants with abundant experience, expecting objective oversight of management based on their deep insight.

To further increase the objectivity and transparency of the nomination of candidates for Directors, the Company has established the Nomination Advisory Committee whose members mainly comprise outside Directors. This committee is involved in the examination of the composition and size of the Board of Directors and the nomination policy for officers and provides advice.

Diversity of Expertise and Experience of Directors/Audit & Supervisory Board Members (Skills Matrix)

In order to “contribute to life and living for people around the world,” the Company pursues two aspects of sustainability: “contributing to a sustainable society” and “sustainable increase in corporate value.” To this end, we have identified the knowledge, experience, and capabilities required to advance Group management and its supervision and auditing at a higher level in a discontinuous and uncertain business environment, and have considered the composition of the Board of Directors with consideration to the balance of its diversity and independence.

Specifically, in addition to “corporate management and strategy,” “finance and accounting,” “legal affairs, intellectual property, and risk management,” and “R&D, manufacturing, and technology,” which are indispensable for pursuing opportunities and reducing risks, we also emphasize “global” to align with the internationalization of markets and businesses, “digital” to advance digital transformation, “environment and society” to respond to changes in the social environment and the status of stakeholders with agility, and “human resource management” to utilize people as the foundation of business management.

| Skills | Directors | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Hideki Kobori | Koshiro Kudo | Kazushi Kuse | Toshiyasu Horie | Masatsugu Kawase | Tsuyoshi Okamoto | Yuko Maeda | Chieko Matsuda | Yoshinori Yamashita | ||||||

| I | I | I | I | |||||||||||

| Corporate Management (experience as President of a listed company) | ● | ● | ● | ● | ||||||||||

| Management Strategy, Organization Operation | ● | ● | ||||||||||||

| Finance, Accounting | ● | ● | ||||||||||||

| Sustainability | ● | ● | ● | ● | ||||||||||

| Global Businesses | ● | ● | ||||||||||||

| R&D, Innovation, DX | ● | ● | ● | |||||||||||

| Manufacturing & Quality Assurance | ● | ● | ||||||||||||

| Human Resources, DE&I | ● | ● | ● | |||||||||||

| Legal Affairs, Risk Management | ||||||||||||||

| Skills | Audit & Supervisory Board Members | |||||

| Takuya Magara | Hiroki Ideguchi | Akemi Mochizuki | Haruyuki Urata | Yoshikazu Ochiai | ||

| I | I | I | ||||

| Corporate Management (experience as President of a listed company) | ||||||

|---|---|---|---|---|---|---|

| Management Strategy, Organization Operation | ● | ● | ||||

| Finance, Accounting | ● | ● | ● | |||

| Sustainability | ● | |||||

| Global Businesses | ● | ● | ||||

| R&D, Innovation, DX | ● | |||||

| Manufacturing & Quality Assurance | ● | |||||

| Human Resources, DE&I | ● | |||||

| Legal Affairs, Risk Management | ● | ● | ● | |||

- (Notes) 1

- The above table indicates up to four major skills for each individual and does not represent all of their skills.

- 2

- “Corporate Management (experience as President of a listed company)” is positioned as broad and diverse experience,

including elements of other skills listed in the above table.

| Skills | Reasons and details of skill selection | |

| Corporate Management (experience as President of a listed company) | In light of the management environment of the Group which is accelerating business portfolio transformation, the selection was made because outstanding leadership and diverse experience as the head of a listed company are necessary. | |

|---|---|---|

| Management Strategy, Organization Operation | Selected the experience and expertise in planning and executing management strategies, managing large-sized organizations, etc., since they are necessary for supervising management strategy, which is the main agenda for the Board of Directors of the Company. | |

| Finance, Accounting | Selected the experience and expertise in planning and executing capital policy and capital allocation, and accounting insights, etc., since they are necessary for business portfolio transformation and management aiming for capital efficiency. | |

| Sustainability | Selected the experience and expertise in supervising sustainability issues at the management level, including carbon neutrality, circular economy, and dealing with human rights, which are core subjects of management strategy. | |

| Global Businesses | Selected the experience and expertise in leading or supervising international operations, including managing in the global business environment and promoting overseas business operations, since the Company has numerous overseas sites and is strengthening its expansion into global markets. | |

| R&D, Innovation, DX | R&D, innovation, and DX are the source of the Group’s sustainable growth. The experience and expertise in these fields were selected since they are necessary for creating value through them and preventing damage by using cybersecurity, etc. | |

| Manufacturing & Quality Assurance | Selected the experience and expertise in manufacturing technology, quality assurance, and safety technology since they are essential to the Group’s business execution. | |

| Human Resources, DE&I | Selected the experience and expertise in this field to create innovations and businesses as well as to promote the active participation and growth of human resources by planning and executing human resources measures aligned with the management strategies and promoting diversity, equity and inclusion (DE&I). | |

| Legal Affairs, Risk Management | Selected the experience and expertise in the legal field, compliance and insights, etc. on risk management, since they are essential to the Group’s sustainable growth and prevention of damage. | |

Evaluation of the Effectiveness of the Board of Directors

The Board of Directors of the Company conducts regular evaluations of its own effectiveness every fiscal year. The results of the evaluation of the effectiveness of the Board of Directors (hereinafter, “the fiscal year’s evaluation”) in fiscal 2024 are summarized as follows. In order to maintain an evaluation cycle that also incorporates an objective perspective, the Company will continue to use the third-party organization on a regular basis for evaluating the effectiveness of the Board of Directors.

1. Process of the fiscal year’s Evaluation

- (1)December 2024

The Company’s Board of Directors deliberated on the implementation process and survey content of the fiscal year’s evaluation. - (2)From December 2024 to January 2025

Survey of all Directors and Audit & Supervisory Board Members was conducted. The survey covered not only the Board of Directors, but also the Nomination Advisory Committee and Remuneration Advisory Committee. The survey topics included the functions, operation and discussion status of meetings of the Board of Directors, the Nomination Advisory Committee, and Remuneration Advisory Committee, and individual evaluation (self-evaluation) of all Directors and Audit & Supervisory Board Members. - (3)March and April 2025

The Company’s Board of Directors confirmed the results of the evaluation of the effectiveness of the Board of Directors based on the survey results above, and deliberated on responses to the issues identified.

2. Summary of results of the evaluation

- (1)The Company’s Board of Directors confirmed that the effectiveness of the Board of Directors is sufficiently ensured, particularly in the following aspects.

- Based on the Board of Directors’ vision to promote business portfolio management and strengthening of the business platform, the roles and functions of the Company’s Board of Directors were evaluated as being appropriately fulfilled, as it increased the opportunities to discuss business portfolio transformation and conducted substantial deliberations.

- The Board of Directors was evaluated for deepening the deliberations on the new medium-term management plan from multiple perspectives by business sector and by subject, and for enhancing discussion with an awareness of the perspective of capital markets.

- In operational aspects, the Board of Directors was evaluated for maintaining an environment that encourages open and lively discussion, and for achieving highly effective and efficient operation through continuous improvements of issues identified from the results of the evaluation of the effectiveness of the Board of Directors.

- (2)On the other hand, the Company’s Board of Directors shared that there are still issues regarding the following points.

- The Board of Directors recognizes the importance of utilizing the Board of Directors meetings and off-site settings to further deepen discussions from a medium- to long-term perspective on material management issues, including the way of three-sector management, financial strategy, shareholder returns, and capital efficiency.

- Regarding raising the quality of discussions by the Board of Directors, the Board of Directors confirmed the importance of having discussions with an awareness of the perspective of capital markets, and recognizes that there is room for further enhancement of the discussions.

- The Board of Directors recognizes the need to further enhance the operation of the Nomination Advisory Committee and Remuneration Advisory Committee, and to continue effective consideration of the Board of Directors composition and officer remuneration.

3. PDCA cycle of evaluation of the effectiveness of the Board of Directors and future measures

The Company’s Board of Directors identifies the issues to be addressed to further enhance the effectiveness of the Board of Directors, and implements measures for improvement as follows.

| Plan: Direction of measures for fiscal 2024 |

Do: Primary measures during fiscal 2024 |

Check: Evaluation for the fiscal year |

Act: Future measures |

||

|---|---|---|---|---|---|

|

Deliberation subjects/deliberation quality |

|

|

|

|

| Operation |

|

|

|

|

|

|

|

|

|

|

|

Remuneration of Directors

Note: Percentages shown for Directors who have executive responsibilities (FY2024)

| Fixed base remuneration | Performance-linked monetary remuneration | Stock-based remuneration |

|---|---|---|

| 60.9% | 27.3% | 11.8% |

- Performance-linked monetary remuneration → commitment to results

- Stock-based remuneration → perspective of shareholders

- (Note) Outside Directors receive fixed base remuneration only

The amount of remuneration, etc. of Directors and Audit & Supervisory Board Members in fiscal 2024

| Classification | Amount Paid (¥ million) | Breakdown by remuneration type (¥ million) | Number of Directors and Audit & Supervisory Board Members Paid | ||

|---|---|---|---|---|---|

| Basic remuneration | Performance-linked monetary remuneration | Stock-based remuneration | |||

| Directors | 616 | 455 | 113 | 48 | 11 |

| (of which Outside Directors) | 72 | 72 | - | - | 5 |

| Audit & Supervisory Board Members | 158 | 158 | - | - | 5 |

| (of which Outside Audit & Supervisory Board Members) | 54 | 54 | - | - | 3 |

| Total | 774 | 613 | 113 | 48 | 16 |

- (Note) In this table, “Stock-based remuneration” represents an amount expected to be charged for the next fiscal year, not an amount that was charged for the fiscal year under review. The Company charges the stock-based remuneration on a day when points are conferred based on the Share Grant Regulations. The point conferment date is set to a day in the next fiscal year of the fiscal year in which the target achievement base date for the points (the final day of the fiscal year) exists.

Policy on Determining Remuneration Amounts and Calculation Methods

As one of the corporate governance mechanisms to ensure that the Group can achieve sustainable growth and enhance corporate value over the medium to long term, the Company has sought advice of the Remuneration Advisory Committee on the decision-making policy pertaining to the contents of remuneration, etc. for individual Directors (hereinafter, the "Decision-making Policy"). Respecting the contents of the reports thereof, the Board of Directors has made a resolution on the Decision-making Policy as follows.

The remuneration for Audit & Supervisory Board Members consists of fixed remuneration, since the performance-linked remuneration system is not applied in the remuneration for them. Individual remuneration amounts are determined through discussions with Audit & Supervisory Board Members.

Policy for Determining Director Remuneration

- 1. Basic policy

The Directors’ remuneration of the Company is one of the important components of corporate governance. The Company designs this system to provide appropriate incentives to both executives and supervisors for achieving sustainable growth and improving medium- to long-term corporate value.

Remuneration for Non-executive Directors* including Outside Directors, who supervise the management of the Company, is comprised solely of fixed basic remuneration at a level determined in consideration of third-party survey data, in order to secure a high degree of independence unaffected by earnings fluctuations.

The remuneration for Executive Directors combines performance-linked monetary remuneration with stock-based remuneration as nonmonetary remuneration, in addition to fixed basic remuneration, in order to provide incentives tied to earnings and management strategy as senior management, with levels of remuneration amounts and proportions of types of remuneration adjusted as appropriate for each role according to management strategy and tasks, in consideration of third-party survey data.

To ensure the optimal way of remunerating Directors and design of the remuneration system, the Board of Directors and the Remuneration Advisory Committee regularly deliberate and continually confirm their appropriateness and make improvements. - 2. Policy for determining the timing for payment and conditions of remuneration

Basic remuneration and performance-linked monetary remuneration are paid monthly. For stock-based remuneration, points described below are granted to eligible Directors on a certain date each fiscal year set forth in the Share Grant Regulations determined by the Board of Directors, and shares of the Company are provided to eligible Directors at the time they retire both as Director and as officer of the Group in light of the purpose of the stock-based remuneration to share the medium- to long-term perspectives of shareholders. - 3. Policy for determining each individual’s basic remuneration (monetary remuneration)

Amounts of basic remuneration for Directors are determined through comprehensive consideration in accordance with rank and responsibility taking account of other companies’ levels of remuneration and the Company’s earnings. - 4. Policy for determining content of performance-linked monetary remuneration and nonmonetary remuneration as well as method of calculating amounts and numbers thereof

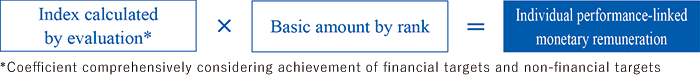

Performance-linked monetary remuneration, which comprises a part of remuneration for Executive Directors, combines both achievement of financial targets including invested capital efficiency with achievement of non-financial targets including individual targets such as progress on sustainability, so as to provide incentives tied to earnings and management strategy as senior management.

Performance-linked monetary remuneration is calculated based on a comprehensive judgment on the basis of achievement of financial targets such as operating income, ROIC, etc., together with achievement of individually set targets including progress on sustainability. Standards for financial incentives are selected as appropriate for clear and objective evaluation based on earnings results together with the perspective of awareness for improving invested capital efficiency.

The formula required to calculate individual performance-linked monetary remuneration is outlined as follows.[Formula required to calculate individual performance-linked monetary remuneration]

A portion of remuneration for Executive Directors is the provision of stock-based remuneration as non-monetary remuneration. To share with shareholders not only the benefits of share price increases but also the risk associated with share price decreases, a stock-based remuneration system was adopted, whereby a trust established by the Company acquires shares of the Company and grants them to eligible Directors. Based on the Share Grant Regulations adopted by the Board of Directors, eligible Directors are granted points linked to achievement of targets set by the medium-term management plan in accordance with their rank, etc. (maximum of 150,000 points per fiscal year) and the Company’s shares are granted to eligible Directors corresponding to the accumulated number of points at the time of their retirement as Director and as officer of the Group (the number of shares to be granted is the number of points granted multiplied by 1.).

- 5. Policy for determining the proportion of basic remuneration, performance-linked monetary remuneration, and nonmonetary remuneration for individual Executive Directors

The proportion of basic remuneration, performance-linked monetary remuneration, and stock-based remuneration for each Executive Director is determined to provide an appropriate incentive in accordance with management strategy and management tasks, with consideration given to the level obtained from third-party survey data.

The proportion of basic remuneration, performance-linked monetary remuneration, and stock-based remuneration for each Executive Director is generally 4:3:3, with performance-linked monetary remuneration ranging between 0% to 200% of the base amount based on rank, according to evaluation. However, the Board of Directors and the Remuneration Advisory Committee regularly deliberate on its appropriateness, and improvement is made based on continual confirmation of appropriateness. - 6. Policy for determining items to be entrusted regarding determination of content of remuneration of individual Directors and for determining content of remuneration of individual Directors

Among remuneration of each individual Director, determination of the amount of performance-linked monetary remuneration is entrusted to the Remuneration Advisory Committee based on a resolution of the Board of Directors, with the Remuneration Advisory Committee being authorized to confirm the reasonableness and appropriateness of the evaluation of the achievement of targets by each Executive Director as proposed by the President and Director, and to determine performance-linked monetary remuneration amounts for individual Directors by applying this evaluation to the formula determined by the Board of Directors.

To ensure that such authority is properly exercised, Outside Directors comprise a majority of the Remuneration Advisory Committee, and it regularly reports to the Board of Directors on the process of the above confirmation and determination.

Regarding determination of basic remuneration and stock-based remuneration for individual Directors, the Board of Directors requests deliberation by the Remuneration Advisory Committee and makes a determination based on ample consideration of the result of deliberation by the Remuneration Advisory Committee.

Fixed basic remuneration by rank is paid upon determination of the amount by the Board of the Directors. Stock-based remuneration is granted to eligible Directors when certain conditions are met, corresponding to points granted to each Director based on the Share Grant Regulations adopted by the Board of Directors. - 7. Important matters for determining the content of individual remuneration, etc. for Directors

In the event that a Director who is eligible for payment of stock-based remuneration, which is nonmonetary remuneration, as part of the above-stated remuneration for Executive Directors, retires due to personal reasons (except in cases where it is determined that the resignation is due to unavoidable circumstances), and in the event that a Director is dismissed or resigns due to causing loss or damage to the Company’s group companies as defined in the Share Grant Regulations, etc., all or some of the points granted up to that point shall be forfeited and no shares of the Company corresponding to the forfeited points shall be granted, or no further points shall be granted, based on a resolution of the Board of Directors.

- *Non-executive Directors include the Chairman & Director.

Independence Standards and Qualification for Outside Directors/Audit & Supervisory Board Members

In determining that Outside Directors and Outside Audit & Supervisory Board Members are independent, the Company ensures that they do not correspond to any of the following and that they are capable of performing their duties from a fair and neutral standpoint.

- 1. A person who conducts business on behalf of the Group (Executive Directors, Executive Officers, Operating Officers, employees, etc.) or a person who has done so over the last 10 years

- 2. A company or a person who executes the businesses thereof whose major business partner is the Group (an entity with more than 2% of its annual consolidated net sales coming from the Group)

- 3. A major business partner of the Group (when payments by this partner to the Group account for more than 2% of the Company's annual consolidated net sales or when the Company borrows money from such partner amounting to more than 2% of the Company's consolidated total assets) or a person who executes the businesses thereof

- 4. A person who receives a large amount of money or other financial gain (¥10 million or more in one year) from the Group as an individual other than remuneration for being a Director/Audit & Supervisory Board Member of the Company

- 5. A company which receives a large amount of donations or aid (¥10 million or more in one year) from the Group or a person who executes the businesses thereof

- 6. A main shareholder of the Group (a person/company who directly or indirectly owns 10% or more of all voting rights of the Company) or a person who executes the businesses thereof

- 7. A person who executes the businesses of a company which elects Directors/Audit & Supervisory Board Members/employees of the Group as Directors/Audit & Supervisory Board Members

- 8. An Independent Auditor of the Group or any staff thereof

- 9. A person who has fallen into any of the categories 2 through 8 above over the last three years

- 10. A person who has a close relative (spouse, relative within the second degree of kinship, or those with whom they share living expenses) who falls under any of the categories 1 through 8 above, provided that "a person who executes businesses thereof" in 1, 2, 3, 5, 6, and 7 above shall be replaced with "an important person who executes the businesses thereof (Executive Directors and Executive Officer, etc.)"

- 11. A person who has served as Outside Director or Outside Audit & Supervisory Board Member of the Company for more than eight years in total.

Status of Audits by Audit & Supervisory Board Members, Financial Audits and Internal Audits

- For internal audits of business execution, the company has established an Internal Audit Department, reporting directly to the President. The Internal Audit Department formulates an annual audit plan according to the Company's Basic Regulation for Internal Audits, and conducts an audit of the Group under the approval of the President.

- As for audits by Audit & Supervisory Board Members, each Audit & Supervisory Board Member audits the execution of duties of Directors by attending meetings of the Board of Directors and examining the status of execution of operations based on the audit policy stipulated by Audit & Supervisory Board. To support the function of the Audit & Supervisory Board, the Company has established an Audit & Supervisory Board Members Office.

- PricewaterhouseCoopers Japan LLC is contracted as the Independent Auditors to perform financial audits according to the Companies Act and Financial Instruments and Exchange Act.

- Mutual cooperation between the Internal Audit Department, Audit & Supervisory Board, and Independent Auditors is reinforced through periodic liaison meetings of the Internal Audit Department, Audit & Supervisory Board, and Corporate Auditors of core operating companies, etc. During these meetings, the effectiveness of the Group's internal control system for legal compliance and risk management is reviewed. In addition, the Audit & Supervisory Board confirms the audit plan with the Independent Auditors and receives reports of the results of audits on the Group at the end of the quarterly consolidated accounting period and at the end of the annual consolidated accounting period.

- Details of Independent Auditors Remuneration (NOTICE OF THE 134th ORDINARY GENERAL MEETING OF SHAREHOLDERS)

- Asahi Kasei Report

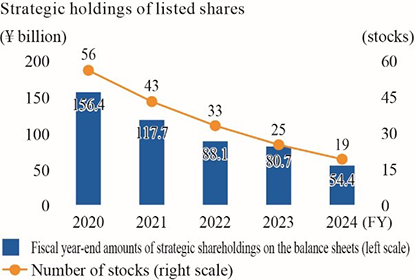

Strategic Shareholdings

The Company is continuing to reduce its holdings of shares held for purposes other than pure investment (strategic shareholdings), taking into consideration factors such as the risk of share price fluctuations, costs associated with such holdings, and capital efficiency.

The purpose, effectiveness and economic rationale of individual strategic shareholdings are regularly evaluated from qualitative and quantitative aspects each year, and are reviewed by the Board of Directors.

As a result of the verification, the Company reduces, through sales or other means, holdings of shares judged to be no longer compatible with the purpose of holding them or deemed to have costs and risks that outweigh the benefits of holding them, taking into consideration the conditions of the company concerned.