Medium-term Management Plan

The Asahi Kasei Group is advancing a medium-term management plan (MTP) for the three-year period from fiscal 2022 to fiscal 2024 centered on the theme “Be a Trailblazer” based on a longer-term vision. Under the unchanging Group Mission, this MTP continues Asahi Kasei’s aim for “contributing to sustainable society” and “sustainable growth of corporate value” as two mutually reinforcing aspects of sustainability, with strategies directed toward a long-term vision for the future.

Asahi Kasei Group objectives for 2030

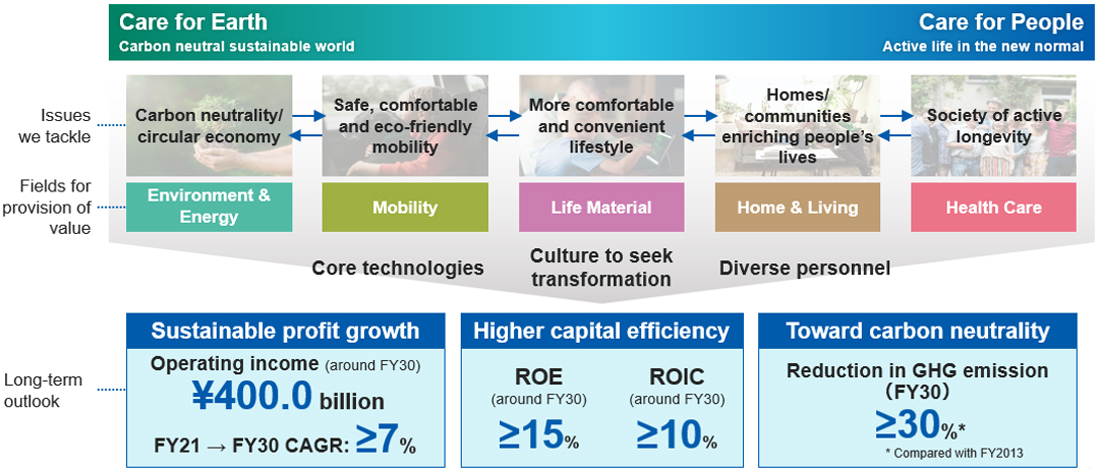

It is expected that social challenges will continue to be less industry-specific and more interrelated, leading to mutual coordination. To provide solutions, the Asahi Kasei Group will more clearly focus on its five fields for provision of value while leveraging its strengths of core technologies, a culture to seek transformation, and diverse human resources. Targets for around fiscal 2030 are operating income of ¥400 billion, ROE of 15% or more, and ROIC of 10% or more, while reducing GHG emissions by 30% or more in fiscal 2030 from the fiscal 2013 level.

Vision for 2030

Overview and progress of the MTP

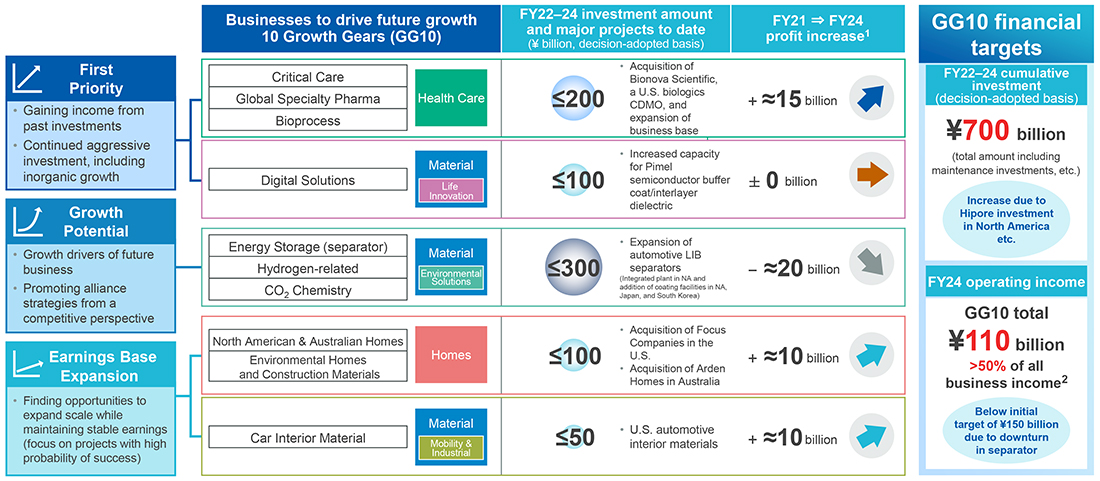

As the first step toward our objectives for 2030, the MTP prioritizes resource allocation on the next growth businesses while initiating fundamental business structure transformation from a longer-term perspective. We aim to gain effect of structural transformation on businesses with sales of over ¥100 billion by the end of fiscal 2024, and to implement structural transformation of petrochemical chain-related businesses with sales of some ¥600 billion.

Investment for long-term growth will be concentrated on “10 Growth Gears” (GG10) businesses that will drive future growth, with decisions on some ¥700 billion of investment now expected over the 3-year period, exceeding the original outlook of ¥600 billion. GG10 are expected to contribute more than 50% of business income in fiscal 2024. At the same time, we will continue to implement thorough financial discipline in investment judgements.

Progress on GG10

1 Operating income + amortization from PPA

2 Proportion of business income, excluding corporate expenses

In addition to ongoing strengthening of the management platform focused on Green, Digital, and People (GDP) perspectives, “maximum use of intangible assets” is added as a fourth area of focus.

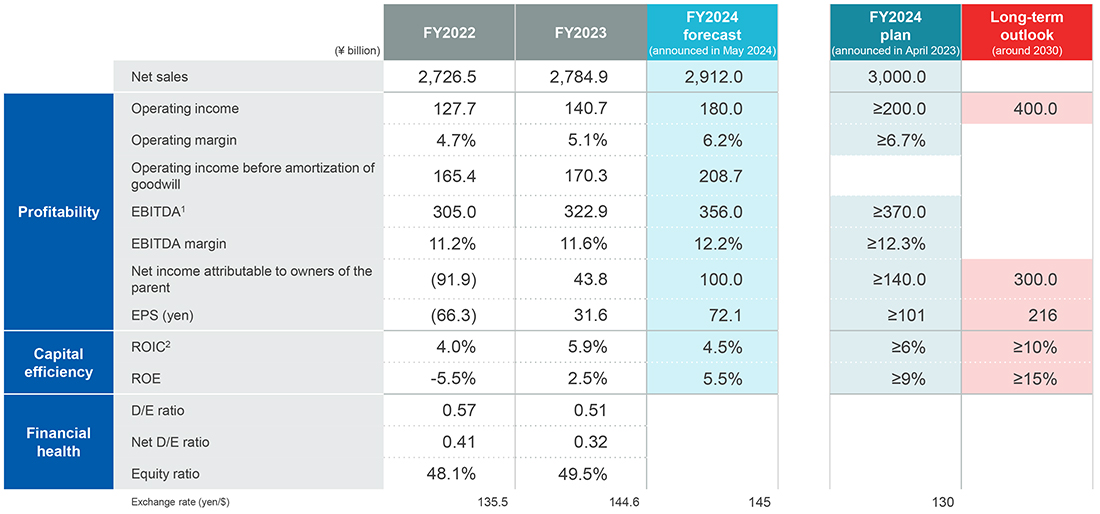

Key financial performance indicators to achieve sustainable growth of corporate value are profit growth, ROE, and ROIC. Considering the sluggish performance of Material in fiscal 2022 and 2023, and the impact of recording impairment loss, fiscal 2024 targets were revised to operating income of ¥180 billion, ROE of 5.5%, and ROIC of 4.5%. We will continue to advance portfolio transformation and investments for growth to generate income and raise capital efficiency. The original operating income target of ¥270 billion is to be achieved in fiscal 2026 or 2027. Shareholder returns will basically be by dividends, based on a policy emphasizing stable dividends, with the aim of maintaining and raising dividends as earnings expand.

Financial targets (May 2024 update)

1 Operating income, depreciation, and amortization (tangible, intangible, and goodwill)

2 (Operating income − income taxes) / average annual invested capital