Asahi Kasei launches new medium-term management plan

April 11, 2022

Asahi Kasei Corp.

The Asahi Kasei Group has launched a new medium-term management plan (MTP) for the three-year period from fiscal 2022 to fiscal 2024 centered on the theme “Be a Trailblazer” based on a longer-term vision.

In the previous medium-term management plan, entitled “Cs+ for Tomorrow 2021,” Asahi Kasei advanced growth strategies in fields for provision of value, and implemented measures to reinforce the platform for sustainable growth focused on Green, Digital, and People (GDP) perspectives. Under the unchanging Group Mission, the new MTP continues Asahi Kasei’s aim for “contributing to sustainable society” and “sustainable growth of corporate value” as two mutually reinforcing aspects of sustainability, with strategies directed toward a long-term vision for the future.

Recap of Cs+ for Tomorrow 2021

Having growth strategies aligned with the Environment & Energy, Mobility, Life Material, Home & Living, and Health Care as five fields for provision of value, decisions were adopted on approximately ¥850 billion of investment for growth during the three-year period from fiscal 2019 to fiscal 2021, with proactive M&A centered on the Health Care and Homes sectors. Business portfolio transformation was advanced with reform of Strategic Restructuring Businesses whose performance had lagged, and acceleration of technological development and commercialization in areas expected to form future pillars of business such as green hydrogen and CO2 chemistry. Various measures were promoted from the GDP perspectives to strengthen the management platform for sustainable growth. Efforts are now focused on reaping the fruits of such measures for growth, for increased earnings and higher capital efficiency.

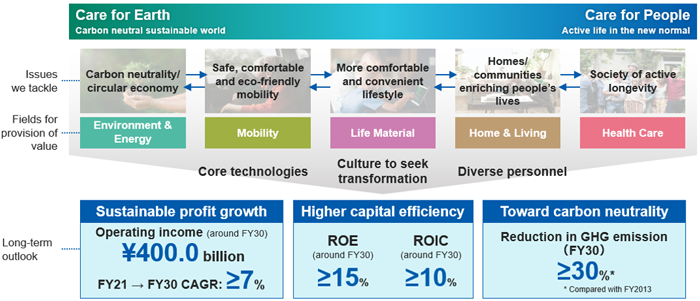

Aims of Asahi Kasei

It is expected that social challenges will continue to be less industry-specific and more interrelated, leading to mutual coordination from a longer-term perspective. To provide solutions, the Asahi Kasei Group will more clearly focus on its five fields for provision of value while leveraging its strengths of core technologies, a culture to seek transformation, and diverse human resources. Targets for around fiscal 2030 are operating income of ¥400 billion, ROE of 15% or more, and ROIC of 10% or more, while reducing GHG emissions by 30% or more in fiscal 2030 from the fiscal 2013 level.

(Figure 1)

Overview of the new MTP

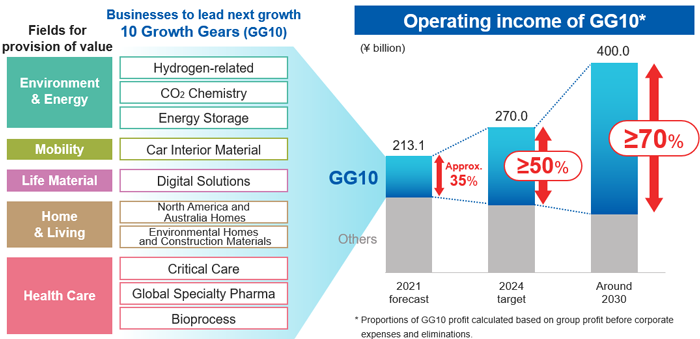

Positioned as the first step toward the vision for 2030, the new MTP prioritizes resource allocation on the next growth businesses, with business portfolio evolution by embarking on a fundamental business structure transformation from a longer-term perspective. Business portfolio evolution will be advanced with a strong awareness of the three aspects of “speed,” “asset light,” and “high value-added” while implementing both “challenging investment for growth” and “cash generation from structural transformation and strengthening existing businesses.”

Challenging investment for growth will be concentrated on ten businesses that will drive the future growth of the Asahi Kasei Group as “10 Growth Gears” (GG10), including proactive M&A. While GG10 contributed approximately 35% of overall business profit in fiscal 2021, this is targeted to rise to 50% or more in fiscal 2024 and 70% or more around fiscal 2030.

(Figure 2)

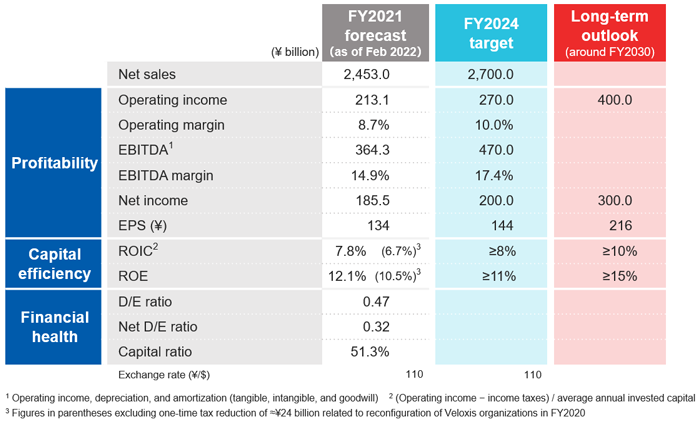

In addition to ongoing strengthening of the management platform from the GDP perspectives, “maximum use of intangible assets” is added as a fourth area of focus.

Key financial performance indicators to achieve sustainable growth of corporate value are profit growth, ROE, and ROIC, with fiscal 2024 targets being operating income of ¥270 billion, ROE of 11% or more, and ROIC of 8% or more. To achieve future growth, investment of ¥1 trillion or more is planned over the three-year period, of which approximately ¥600 billion will be for GG10 as growth drivers. Shareholder returns will basically be by dividends, with the aim of raising returns as earnings expand.

(Figure 3)

Figure 1: Vision for 2030

Figure 1: Vision for 2030

Figure 2: GG10

Figure 2: GG10

Figure 3: Financial targets

Figure 3: Financial targets

Disclaimer:

The forecasts and estimates shown in this press release are dependent on a variety of assumptions and economic conditions. Plans and figures depicting the future do not imply a guarantee of actual outcomes.