Asahi Kasei launches “Trailblaze Together” medium-term management plan for fiscal 2025–2027

April 10, 2025

Asahi Kasei Corp.

The Asahi Kasei Group has launched “Trailblaze Together” as a medium-term management plan (MTP) for the three-year period from fiscal 2025 to fiscal 2027. The new MTP sets forth a long-term vision for Asahi Kasei together with accordant policies and strategies for the next three years.

Recap of previous MTP

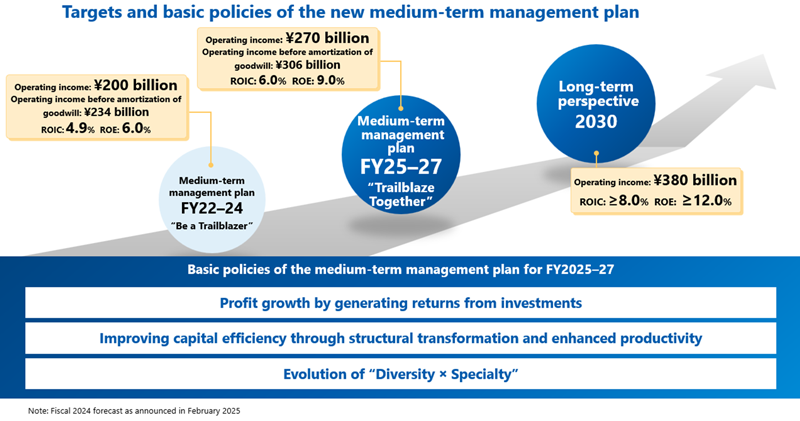

In the previous MTP for fiscal 2022 to fiscal 2024, focused on the theme “Be a Trailblazer,” Asahi Kasei implemented business portfolio transformation through both investment for growth and structural transformation, with strong awareness of the three aspects of “speed,” “asset light,” and “high value-added.” During the three-year period, investment decisions of some ¥700 billion were made centered on the 10 Growth Gears (GG10) businesses to drive future growth, such as the acquisition of Swedish pharmaceutical company Calliditas Therapeutics AB, and investment on lithium-ion battery separator for automotive applications.

Regarding structural transformation, decisions were made on businesses with sales totaling over ¥80 billion, including divestiture of the blood purification business. In the petrochemical chain related businesses, a decision was made to discontinue acrylonitrile and other operations of PTT Asahi Chemical Co., Ltd. in Thailand, and a feasibility study was started on production optimization of ethylene production facilities in western Japan from a medium- to long-term perspective, including carbon neutrality and future capacity reductions.

Moving forward, Asahi Kasei is working to achieve income growth and improved capital efficiency by generating results from investments while reaping the fruits of structural transformation and productivity improvements.

Aims of the Asahi Kasei Group

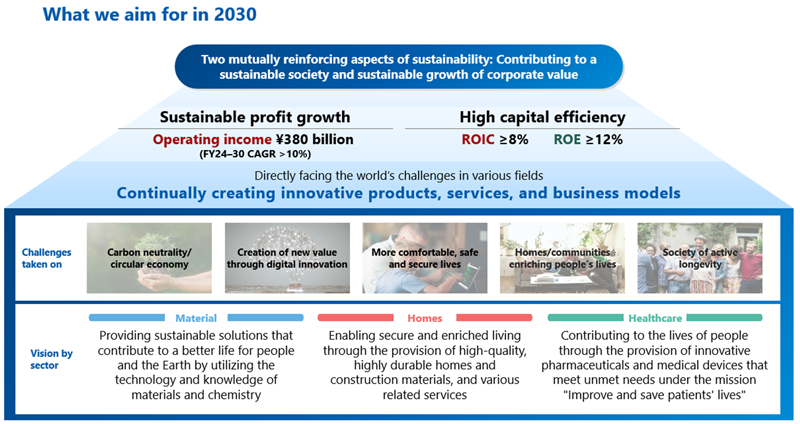

Asahi Kasei aims to continually create innovative products, services, and business models, directly facing the world’s challenges in various fields, to achieve a virtuous cycle of two mutually reinforcing aspects of sustainability: contributing to sustainable society and sustainable growth of corporate value.

Targets for fiscal 2030 are operating income of ¥380 billion, ROIC of 8% or more, and ROE of 12% or more.

Overview of the new MTP

In the new MTP, Asahi Kasei is targeting operating income of ¥270 billion, ROIC of 6%, and ROE of 9% in fiscal 2027.

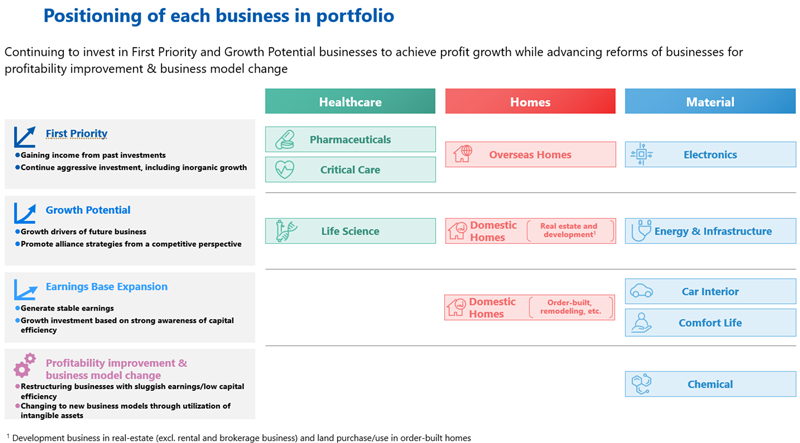

In order to reach its aims for 2030, Asahi Kasei will continue to invest in businesses categorized as First Priority and Growth Potential to achieve income growth, while advancing reforms in the petrochemical businesses identified for profitability improvement & business model change.

Over the three-year period from fiscal 2025 to fiscal 2027, Asahi Kasei expects to adopt decisions on ¥1 trillion of investment (of which approximately ¥670 billion to be expansion-related), approximately the same amount as during the previous MTP. The Healthcare sector will continue to expand mainly through M&A as previously, while the Homes sector will examine the potential of investments for growth both in Japan and overseas. In the Material sector, investments will be carefully selected in targeted fields such as ion-exchange membranes, hydrogen-related, and electronic materials, while structural transformation will be advanced for businesses accounting for approximately 20% of the sector’s sales.

To continue strengthening its management platform, Asahi Kasei further utilize intangible assets with each business achieving sustainable growth of corporate value by sharing and flexibly utilizing its management platform with other businesses.

Regarding shareholder returns, Asahi Kasei aims for medium- to long-term progressive dividends with DOE (dividends on equity) of 3% as a benchmark in order to continuously improve the level of returns.

Based on the spirit of a trailblazer to open new paths, the Asahi Kasei Group not only combines its strengths as a single team, but also works together with various stakeholders, including customers, other companies, and investors, to provide new value.

Disclaimer:

The forecasts and estimates shown in this press release are dependent on a variety of assumptions and economic conditions. Plans and figures depicting the future do not imply a guarantee of actual outcomes.