Climate Change

Click here to read our response to CDP Corporate Questionnaire 2025

- CDP Corporate Questionnaire 2025(Japanese Document)

- (References*)CDP Corporate Questionnaire 2025(English Document)

- *Our official response is in Japanese, and the English response is a machine translation.

Carbon Neutrality Policy

In accordance with its Group Mission, the Asahi Kasei Group is committed to contributing to life and living for people around the world. The Asahi Kasei Group has long been aware that climate change is a global issue that will have a significant impact on both the natural environment and society, and we see it as our mission to use the scientific expertise we have cultivated since our founding to deal with this issue leveraging our combined strength.

In May 2021, the Asahi Kasei Group adopted a policy for carbon neutrality as described below. (In April 2025, a new target for 2035 was added.)

Greenhouse gas (GHG) emissions targets for the Asahi Kasei Group*

- 2050

- Carbon neutral

- 2035

- Emissions reduction of 40% or more (from fiscal 2013)

- 2030

- Emissions reduction of 30% or more (from fiscal 2013)

- *Scope 1 (direct GHG emissions) and Scope 2 (indirect emissions use of electricity, heat, and steam supplied by other companies), absolute quantity

Initiative Policy

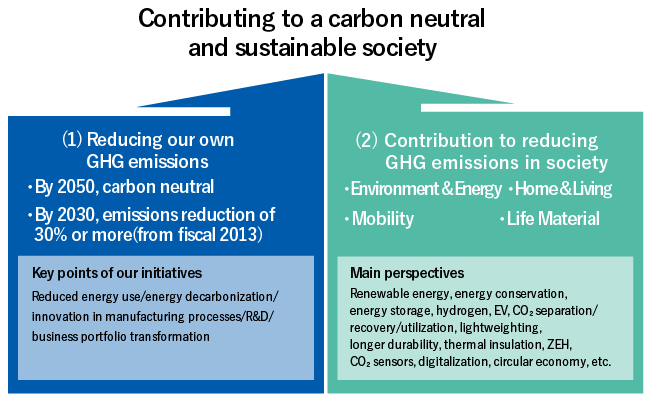

In addition to reducing GHG emissions from our own business activities, we believe that it is also important to help to reduce GHG emissions in society1 through our diverse array of technologies and businesses to deal with climate change. Our materiality explicitly includes initiatives toward “decarbonization”, and in April 2022, we launched the Carbon Neutrality Project2. Under the leadership of the Executive Officer for GX, we are formulating scenarios and implementing specific measures to achieve our GHG emissions reduction targets. In the review process, the President, Executive Officer for Corporate Strategy, and others work to strengthen the content of the program, while regularly confirming its direction.

Regarding "Care for Earth," we are committed to addressing climate change issues group-wide, both in terms of (1) reducing the amount of our own GHG emissions and (2) contribution to reducing the amount of GHG emissions in society through our businesses and technologies.

- 1See our Environmental Contribution Products for our contribution to reducing the amount of GHG emissions in society.

- 2See Disclosure under TCFD Framework > Governance

Key Points of Effort for Carbon Neutrality

Key Points of Effort for Carbon Neutrality

- The Asahi Kasei Group's ESH & QA and Health & Productivity Management Policy

- The Asahi Kasei Group's Global Environmental Policy

Reducing GHG Emissions from Our Own Operations

Concrete measures to reduce GHG emissions and their projected impacts

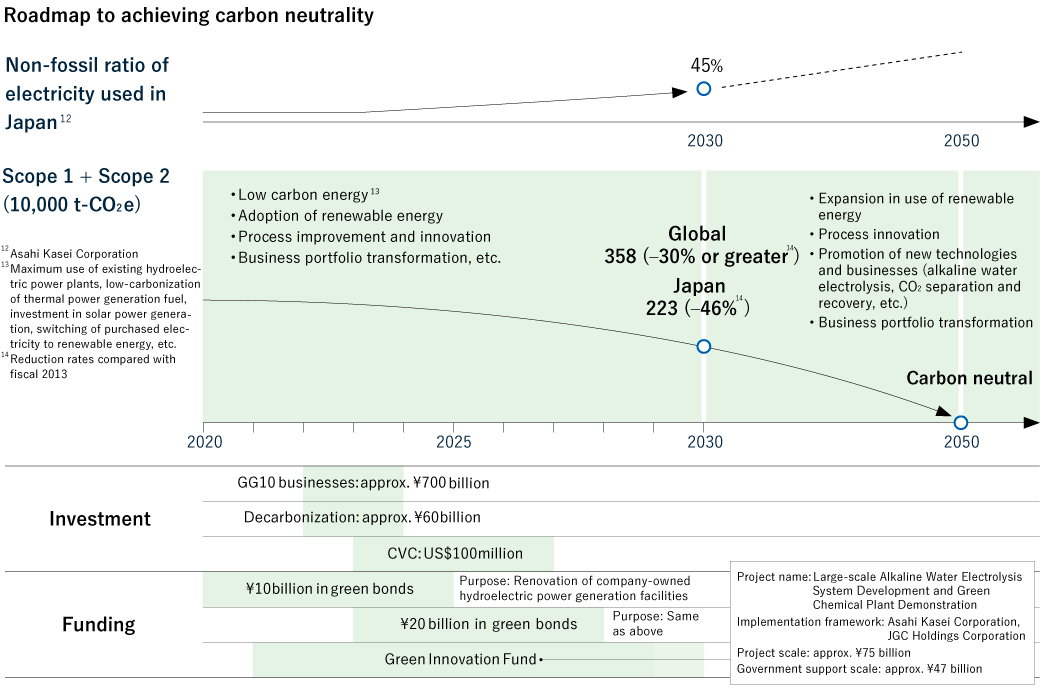

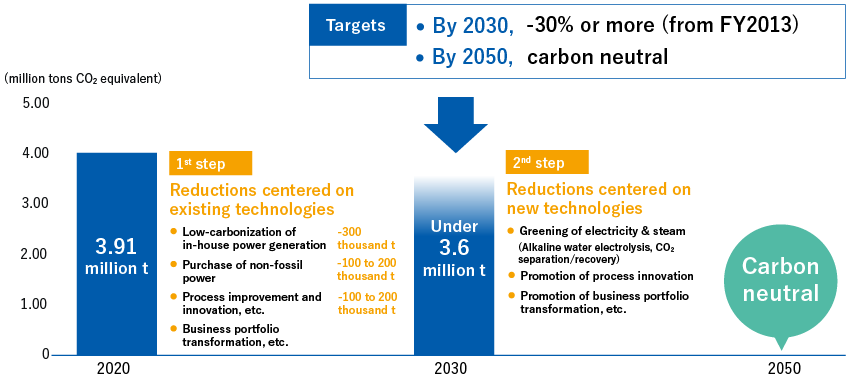

We are targeting a reduction in GHG emissions by at least 30% by 2030, and by at least 40% by 2035 as compared to fiscal 2013, with a goal of becoming carbon neutral by 2050. Measures will be advanced as described below.

We are advancing a wide range of efforts, including reducing energy consumption, decarbonizing energy sources (such as upgrading and utilizing hydroelectric power plants and expanding the use of renewable energy), innovating manufacturing processes, and shifting toward high value-added and low-carbon businesses through transformation of our product and business portfolio.

GHG Emissions Targets (Base year: FY2013 results, Scope 1 & 2)

GHG Emissions Targets (Base year: FY2013 results, Scope 1 & 2)

Scope 1 and 2 GHG emissions (Japan and overseas)

All production sites of Asahi Kasei Corp. and its consolidated subsidiaries under management control are subject to calculation of Scope 1 and Scope 2 GHG emissions of the Asahi Kasei Group, and GHG emissions from generation of electricity and steam sold outside the Asahi Kasei Group are included.

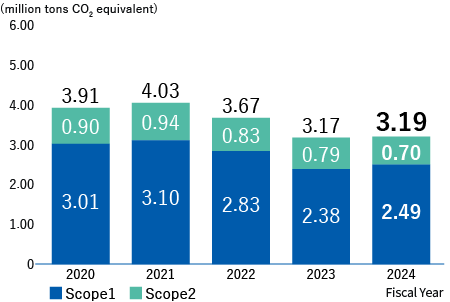

In fiscal 2024, our Scope 1 GHG emissions were 2.49 million tons of CO2-eq, and Scope 2 GHG emissions were 0.70 million tons of CO2-eq, bringing the total of Scope 1 and 2 to 3.19 million tons of CO2-eq. This is a reduction in GHG emissions of approximately 38% compared to the 5.11 million tons of CO2-eq. released in the baseline year of 2013.

- Note:The Scope 1 and 2 GHG emissions data for fiscal 2024 are figures prior to third-party assurance.

Changes in GHG emissions (Scope 1 + Scope 2)*

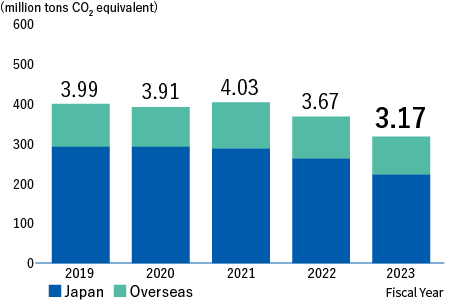

Changes in GHG emissions (Scope 1 + Scope 2)* Changes in GHG emissions (Japan and overseas)*

Changes in GHG emissions (Japan and overseas)*

- *74.3% coverage (company sales included in GHG emissions calculation / total consolidated sales x 100)

- Global greenhouse gas emissions by segment (ESG Data)

- Overseas greenhouse gas emissions by fiscal year (ESG Data)

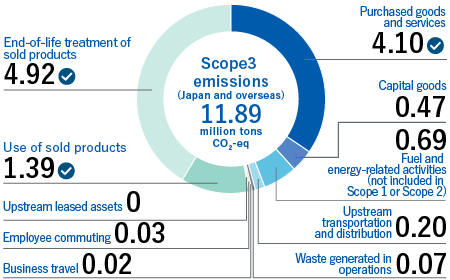

Scope 3 emissions

Scope 3 emissions

Scope 3 emissions

- *The Scope 3 GHG emissions data for fiscal 2024 are figures prior to third-party assurance.

- *Scope 3 emissions: Greenhouse gases emitted indirectly by a company throughout its supply chain. The methods for calculating Scope 3 emissions from Category 1, 5, 11 and 12 are described in Environmental data.

- Note:GHG emissions quantification is subject to uncertainly when measuring activity data, determining emission factors, and considering scientific uncertainly inherent in the Global Warming Potentials.

Efforts to Reduce CO2 Emissions

Renewable energy

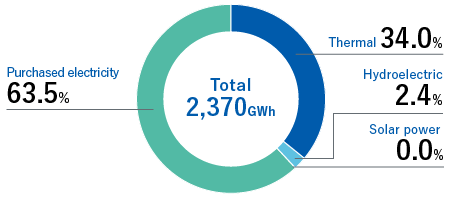

The Asahi Kasei Group has 9 hydroelectric power plants in the Nobeoka/Hyuga region, which provide approximately 3% of the Group’s (Japan and overseas) electricity use. Generation of the equivalent amount of purchasing electricity would result in approximately 30 thousand tons* of CO2 emissions annually.

We also have a biomass power generation facility.

- *Using Japan's Ministry of Economy, Trade and Industry and Ministry of the Environment, Order No. 3 of 423 g CO2/kWh.

Sources of electricity usage, FY2024 (global)

Sources of electricity usage, FY2024 (global)

Renewable energy purchased and generated

The table below shows the amount of renewable energy purchased and generated.2

(Due to factors such as the partial external sale of in-house generated electricity, the total electricity use shown in the graph above does not correspond exactly with the figures for generation and purchase shown in the table below.)

| Type of energy | Unit | FY20241 |

|---|---|---|

| Hydroelectric power generation | MWh | 70,716 |

| Solar power generation | MWh | 330 |

| Biomass3 generation | MWh | 45,183 |

| Purchased non-fossil certificates4 | MWh | 178,294 |

| Biomass3 steam | GJ | 232,151 |

- 1The data for renewable energy purchased and generated in fiscal 2024 are figures prior to third-party assurance.

- 2Hydroelectric power generation with no environmental value under the FIT system is excluded from the tally.

- 3The calculation is made by multiplying the amount of electricity and steam generated by the input ratio of biomass fuel in the co-combustion power generation of biomass and coal.

- 4Purchased non-fossil certificates include purchases for the Asahi Kasei Group.

Using Renewable Electricity in the Homes Business

As part of its efforts to address climate change, in 2019 Asahi Kasei Homes joined RE100—a global initiative that aims for companies to procure 100% of the electricity used in their business activities from renewable energy sources.

With the goal of contributing to carbon neutrality while enhancing resilience and realizing sustainable urban living, Asahi Kasei Homes has been working with customers to generate renewable electricity by promoting the installation of solar power systems in Hebel Haus™ homes and the use of surplus electricity through its power supply service, Hebel Power. As a result, Asahi Kasei Homes achieved its RE100 goal in fiscal 2023—well ahead of its original 2038 target—becoming the first home builder in Japan to do so.

Energy saving in domestic logistics

The Asahi Kasei Group promotes railway shipment with consideration of the environment.

The Asahi Kasei Group's product shipment volume amounted to some 1.0 billion ton-kilometers in fiscal 2024―a increase of around 4% from fiscal 2023―emitting approximately 74 thousand tons of CO2 equivalent―an increase of about 2%. All logistics operations are outsourced, and in cooperation with the transport firms, a wide range of measures are employed to reduce energy consumption and alleviate the environmental impacts of physical distribution. We also actively participate in initiatives as a shipper, such as the “eco-transportation system” executed by local governments.

We have received Eco-Rail Mark certification in recognition of our preferential shipment of products by rail, an ecological mode of transport which results in lower CO2 emissions for a given weight and distance than many other means of transportation.

Domestic promotion of company-owned low-pollution vehicles

The Asahi Kasei Group is phasing in low-pollution vehicles for use in marketing and within plant grounds. In fiscal 2024, some 93% of company-owned vehicles were low-pollution vehicles.

Asahi Kasei green bond

Please see here for more details.

Climate Change Initiatives (Disclosure based on TCFD1 Framework)

Updated on August, 2025

Awareness surrounding climate change

The global average temperature in 2024 has already risen by 1.55°C compared to pre-industrial levels, exceeding the Paris Agreement’s target of limiting the temperature rise to below 1.5°C by the end of this century. According to the United Nations Environment Programme (UNEP)2, unless current efforts to combat global warming are further strengthened, the global average temperature is projected to rise by 2.8°C by the end of the century, heightening the sense of crisis surrounding climate change. Although there are some trends or course adjustments that run counter to climate actions, as well as concerns over increased energy consumption due to the widespread adoption of AI, the Asahi Kasei Group continues to recognize the critical importance of climate change as a global issue. While short-term fluctuations may occur, we believe that, over the medium-to-long term, efforts toward adaptation and mitigation of climate change will continue to progress.

The Asahi Kasei Group’s stance

Over the century since our founding, the Asahi Kasei Group has developed its business by taking challenges in response to the social issues that have changed with the times, transforming ourselves in the process. As climate change compels a fundamental transformation of social systems, we are striving to achieve two mutually reinforcing aspects of sustainability—“contributing to sustainable society” and “sustainable growth of corporate value”—in line with our Group Mission to contribute to life and living for people around the world. Through these efforts, we are taking on the challenge of reaching carbon neutrality by 2050 while achieving sustainable growth of corporate value.

Additionally, we will continue to steadily reduce our greenhouse gas emissions (Scope 1 and 2), and further work to reduce emissions throughout the entire supply chain, including Scope 3 emissions.

- 1TCFD: Task Force on Climate-related Financial Disclosures. Established by the Financial Stability Board (FSB) in 2017, the TCFD was dissolved in October 2023 and its functions were succeeded by the International Financial Reporting Standards (IFRS) Foundation and integrated into the International Sustainability Standards Board (ISSB) standards.

- 2UNEP: United Nations Environment Programme. An organization established to implement the “Declaration on the Human Environment” and the “Action Plan for the Human Environment,” both adopted at the United Nations Conference on the Human Environment.

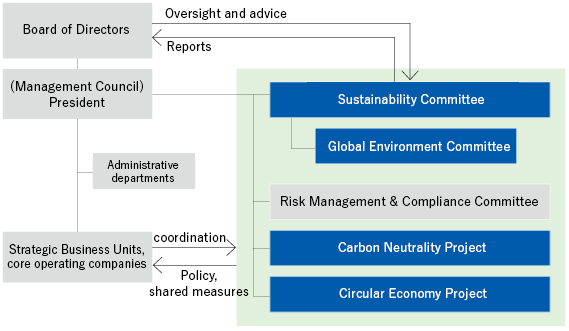

Governance

The Asahi Kasei Group considers green transformation (GX), which focuses on initiatives related to climate change, to be an important management issue, and we are working toward GX by positioning it as one of the core subjects of our management strategy.

Policies and other important matters related to climate change are deliberated and decided by the Board of Directors, while specific related matters are discussed and determined by the Management Council, which serves as the executive decision-making body. These include decisions on the Medium-term Management Plan, GHG emissions reduction targets, and capital investment plans, as well as progress reviews on their implementation. In formulating the Medium-term Management Plan that started in fiscal 2025, discussions were held to review and revise the orientation and goals related to GX, which were then compiled and submitted to the Management Council and Board of Directors for deliberation and approval. The President, who chairs the Sustainability Committee, along with other members of the Board of Directors, possesses the appropriate skills and competencies to drive the Asahi Kasei Group’s climate change strategy.

In order to promote these decisions by the Board of Directors and Management Council at a business level, the Asahi Kasei Group has established the Sustainability Committee chaired by the President, where Executive Officers responsible for each business unit share and discuss issues concerning sustainability, including climate change. The outcomes of these discussions are reported to the Board of Directors and serve as the basis for further deliberations on company-wide initiatives. Under the Sustainability Committee, the Global Environment Committee—chaired by the Executive Officer for GX and comprising Senior General Managers of business units, the Production Center, Corporate Production Technology, and Corporate Research and Development—shares and discusses issues related to environmental matters as a whole. The Carbon Neutrality Project, which is led by the Executive Officer for GX, reviews scenarios and implements specific measures to achieve our targets for reducing GHG emissions. In the review process, the President, Executive Officer for Corporate Strategy, and others work to strengthen the content of the program, while regularly confirming its orientation. Furthermore, the Circular Economy Project, also under the supervision of the Executive Officer for GX, is responsible for formulating the Asahi Kasei Group’s policies and orientation concerning the circular economy, as well as managing progress and driving each related initiative forward.

In the Material sector—which accounts for more than 90% of the Asahi Kasei Group’s total GHG emissions—dedicated departments for carbon neutrality and carbon footprint management were newly established in April 2025. Going forward, we will further strengthen collaboration between the business departments and corporate functions to accelerate our initiatives toward carbon neutrality.

Sustainability Committee

- Sharing, discussion, and alignment of all aspects of ESG, including climate change

- Chair: Asahi Kasei President

Committee members: Executive Officer for Technology Functions, Executive Officer for Business Management Functions, Executive Officers for the 3 business sectors - Main topics in fiscal 2024: after discussing overall trends in sustainability and ESG, the committee shared recognition and held discussions on specific topics such as sustainability disclosures, carbon neutrality, circular economy, hazardous chemicals, natural capital/biodiversity, and human rights

- In principle, held once per year

Global Environment Committee

- Sharing, discussion, and alignment of all aspects of the E (Environment) of ESG

- Chair: Executive Officer for GX

Committee members: Presidents of Business Sectors, Senior General Manager of the Production Center, Senior General Manager of Corporate Production Technology, Senior General Manager of Corporate Research and Development, and others - In principle, held once per year

Carbon Neutrality Project

- Scenario analysis and implementation of specific measures to achieve GHG emissions reduction targets

- Project oversight: Executive Officer for GX, Project General Manager

- In principle, held four times per year

Circular Economy Project

- Examination of Asahi Kasei Group policies and orientation related to the circular economy, and management and promotion of progress in each initiative

- Project oversight: Executive Officer for GX, Project General Manager

- In principle, held four times per year

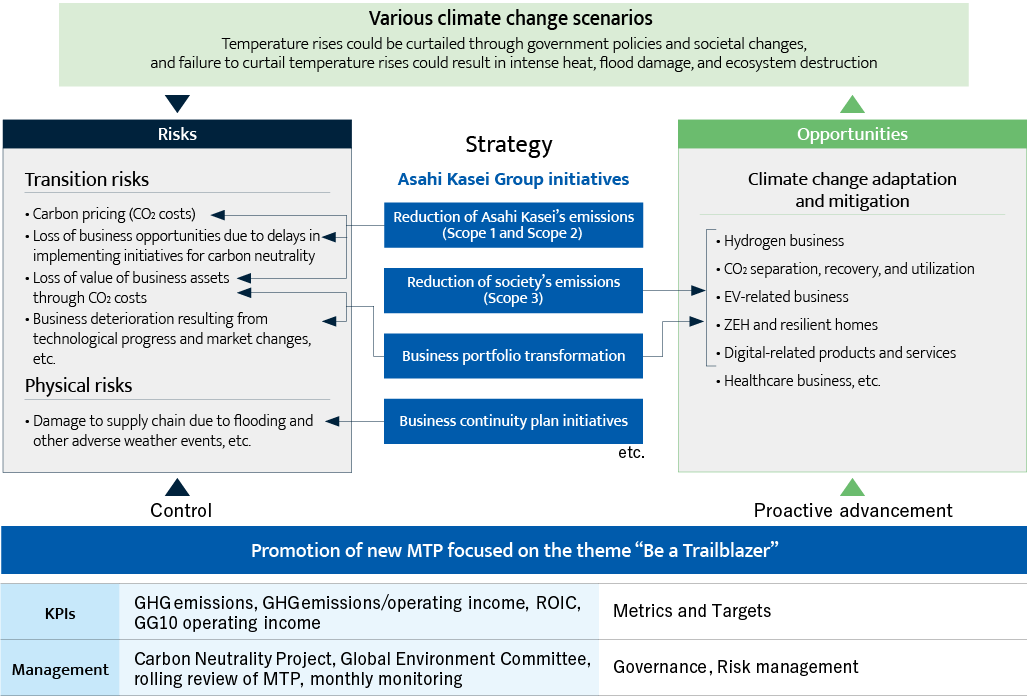

Strategy

Having identified and analyzed key opportunities and risks associated with various climate change scenarios, the Asahi Kasei Group is working to control risk while actively seizing opportunities in accordance with our medium-term management plan.

Underlying assumptions

While a variety of scenarios can be envisaged, depending on the progress of measures to counter global warming, we have analyzed the following two representative scenarios.

- A scenario where GHG emissions are strongly curbed in order to limit global warming to “+1.5°C” since the Industrial Revolution (WEO: Net Zero Emissions by 2050 Scenario [NZE]3)

- A scenario centered on transition risks from tightened controls and major social and market transformation - A scenario where not enough progress is made to prevent global warming, and the temperature increase is “+4°C” (IPCC SSP3-7.04)

- A scenario centered on physical risks from extreme weather events with social and ecological changes

We considered the opportunities and risks in each of the Material, Homes, and Healthcare sectors from the above scenarios.

- Note: These analyses are based on a variety of assumptions, and changes to these assumptions may result in actual risks and opportunities differing significantly.

- 3One of the scenarios listen in the International Energy Agency (IEA)’s WEO (World Energy Outlook) 2024. A scenario that will allow us to achieve worldwide net-zero in 2050 in order to limit the temperature increase to 1.5°C by 2100.

- 4One of the scenarios included in the IPCC’s Sixth Assessment Report. “SSP” stands for “Shared Socioeconomic Pathways” and the SSP3-7.0 is a scenario in which regional rivalry results in climate policies not being adopted, and temperatures rise by up to 4°C in 2100.

Opportunities

We are advancing business portfolio transformation to provide value in anticipation of megatrends, such as the shift to a carbon neutral society. Under the three-year Medium-term Management Plan that started in fiscal 2025, we plan to make expansion-related investments totaling approximately ¥670 billion in First Priority businesses—including Critical Care, Electronics, and Overseas Homes—and in Growth Potential businesses such as Energy & Infrastructure. Of this amount, approximately ¥100 billion will be allocated to investments related to reducing our own GHG emissions.

In addition, we have established a “Care for Earth Investment Framework” ($100 million over 5 years from fiscal 2023 to fiscal 2027) in our CVC activities and are investing in startup companies in the environmental field, as we aim to incorporate and collaborate on new technologies, particularly in response to climate change.

We recognize that the orientation of our business development can provide business opportunities with a variety of products and services in climate change mitigation and adaptation.

-

![【Challenges taken on, issues addressed】Society of active logevity、Homes/ communities enriching people's lives、More comfortable, safe and secure lives、Creation of new value through digital innovation、Carbon neutrality/circular economy

【Business field】[Healthcare]Pharmaceuticals:Therapeutic areas of autoimmune, severe infection transplantation and kidneys(Relationship with climate change scenarios:4°C ○Spread of infectious diseases)、Life Science:Bioprocess(Relationship with climate change scenarios:4°C ○Spread of infectious diseases)、Critical Care:Wearable defibrillators、Professional defibrillators, AEDs [Homes]Domestic Homes:Order-built homes、Real estate、Remodeling、Construction materials(Relationship with climate change scenarios:4°C ◎Resilience and high thermal insulation / 1.5°C ◎Energy saving and high thermal insulation (ZEH)、Overseas Homes:North American homes、Australian homes [Material]Electronics:Electronic materials、Electronic components(Relationship with climate change scenarios:1.5°C ◎Key factors in lifestyle/social system transformation)、Car Interior:Car interior material、Artificial suede(Relationship with climate change scenarios:1.5°C ○ New materials such as monomaterial and biomass materials)Energy & Infrastructure:Separator(Hipore, etc.) 、Ion-exchange membranes, water processing、Hydrogen-related(Relationship with climate change scenarios:4°C ◎Energy saving, renewable energy, resource conservation / 1.5°C ◎Energy saving, renewable energy, resource conservation)、Comfort Life:Fibers、Consumables、Chemical:Performance chemicals( Resin related)、Essential chemicals(Petrochemical related)(Relationship with climate change scenarios:4°C ○Green chemicals / 1.5°C ○Green chemicals)](/sustainability/environment/climate_change/images/index-img-12.png) Disclosure concept on the relationship between climate change scenarios and business

Disclosure concept on the relationship between climate change scenarios and business- 5 Items judged highly relevant, including those directly addressed in the IPCC’s Sixth Assessment Report and the WEO 2024, indicated by double circle: ◎

Items not covered by the above, but considered to be broadly related, indicated by single circle: ○

Items considered neutral in relation to the business, indicated by dash: -

- 5 Items judged highly relevant, including those directly addressed in the IPCC’s Sixth Assessment Report and the WEO 2024, indicated by double circle: ◎

For example, as part of efforts to achieve carbon neutrality by 2050, rapid electrification is expected in the transportation sector, and significant growth in both the battery and hydrogen markets. These are among the Asahi Kasei Group’s highest priority business fields.

![This shows trends in final energy consumption in the global transport sector based on three climate change scenarios: the Stated Policy Scenario (STEPS) [based on existing national policies], the Announced Pledges Scenario (APS) [based on achievement of national targets], and the Net Zero Emissions by 2050 Scenario (NZE). In particular, both the APS and NZE scenarios project an increased share of electricity by 2050.](/sustainability/environment/climate_change/images/index-img-20.png) Projected energy consumption in the transportation sector (2010–2050)6

Projected energy consumption in the transportation sector (2010–2050)6![This presents future projections for battery storage capacity in the global power sector (World electricity sector Battery Storage [GW]) based on three climate change scenarios: the Stated Policy Scenario (STEPS) [based on existing national policies], the Announced Pledges Scenario (APS) [based on achievement of national targets], and the Net Zero Emissions by 2050 Scenario (NZE). Battery storage capacity is projected to increase by a factor of 38.6 times under STEPS, 49.3 times under APS, and 61.9 times under NZE by 2050 compared with fiscal 2023 levels.](/sustainability/environment/climate_change/images/index-img-21.png) Projected battery capacity (2010–2050)6

Projected battery capacity (2010–2050)6![This shows the outlook for the low GHG emissions hydrogen production market [million tons H2] based on three climate change scenarios: the Stated Policy Scenario (STEPS) [based on existing national policies], the Announced Pledges Scenario (APS) [based on achievement of national targets], and the Net Zero Emissions by 2050 Scenario (NZE). The chart illustrates the expected increase in hydrogen production through water electrolysis and fossil fuels with CCUS and bioenergy processes by 2050, with significant expansion of water electrolysis projected under both the APS and NZE scenarios.](/sustainability/environment/climate_change/images/index-img-14.png) Outlook for the low GHG emissions hydrogen production market (2023–2050)66

Outlook for the low GHG emissions hydrogen production market (2023–2050)66

- 6Graphs by Asahi Kasei based on the IEA’s World Energy Outlook 2024.

| Opportunities | |||

| Important Changes | Main opportunities | Principal initiatives, Products | |

| +1.5°C scenario | Transition to a carbon neutral society |

・Promoting the diffusion of ZEH7 and ZEH-M7 by government policy ・Growing demand for renewable energy ・Increasing need for energy conservation ・Growing demand for carbon neutral products |

・Making homes and communities carbon neutral through expansion of ZEH-compliant Hebel Haus* and Hebel Maison* ・Making energy carbon neutral (Hebel Power*) ・Promotion of energy conservation, process innovation (chlor-alkali electrolysis,Neoma Foam*, etc.) ・Utilization of biomass raw materials (bioethanol-derived basic chemicals8, certified biomass products) ・Development of processing technology for specialty chemicals made from CO2 (polycarbonate, components of LIB electrolyte, etc.) ・Development of Environmental Contribution Products ・Promotion of carbon neutrality and enhancing product competitiveness by understanding their carbon footprint of products9 |

|---|---|---|---|

| Spread of electric vehicles (EVs) | ・Growing EV-related demand (Battery components, materials for reducing vehicle weight) |

・Development and supply of next-generation society components and systems (engineering plastics, electronic components, etc.) ・Strengthening of collaboration with automobile and battery manufacturers (LIB separators, automotive interior fabrics, etc.) |

|

| Advent of a hydrogen society | ・Increased demand for water electrolysis that utilizes renewable energy | ・Development and commercialization of green hydrogen production systems (alkaline water electrolysis) | |

| Transition to a circular economy |

・Increased demand for components compatible with a circular economy ・Circular economy-related infrastructure development |

・Development of material and chemical recycling technologies and promotion of their rollout in society ・Utilization of biomass raw materials(bioethanol-derived basic chemicals8, biomass-derived polyamide 66) ・Providing long-life housing (Hebel Haus*, Hebel Maison*, Renovation*, used Hebel Haus*) |

|

| Expansion of the digital market | ・Digital solutions for carbon neutrality in society, life, and industry | ・Promotion of business in electronic devices, such as current sensors and CO2 sensors, and semiconductor and substrate-related electronics materials | |

| +4°C scenario | Serious storm and flood damage | ・Increasing need for disaster-resilient housing | ・Enhancing resilience of homes and communities, including Hebel Haus* and Hebel Maison* |

| Rise in temperature | ・Increasing needs for advanced thermal insulation | ・Providing insulation materials and housing with advanced thermal insulation (Neoma Foam*, Hebel Haus*, Hebel Maison*, remodeling*) | |

| Higher incidences of heat stroke and infectious diseases | ・Growing demand for related pharmaceuticals and medical devices | ・Providing products for pharmaceuticals and medical services, and critical care services | |

- *Pages in Japanese

- 7ZEH (Net Zero Energy House) and ZEH-M (ZEH-Mansion): Houses and apartment buildings with a net energy consumption of zero or less as a result of advanced thermal insulation and energy saving combined with power generation such as solar

- 8 Asahi Kasei Group sustainability briefing materials (January 2023), p. 15

- 9A product’s GHG emissions from raw material extraction to production

Risks

Based on these scenarios, we have analyzed the climate change risks in the Material, Homes, and Healthcare sectors from various perspectives.

Under the +1.5°C scenario, we assume risks arising from tighter regulations through policies such as carbon pricing aimed at achieving carbon neutrality, as well as from shifts in demand toward materials suitable for a carbon neutral society. We also recognize potential risks associated with changes in market structures driven by the emergence of innovative technologies that accelerate the transition to a circular economy and support carbon neutrality.

The +4°C scenario assumes mainly physical risks, such as extreme heatwaves, heavy rain, and flooding. In particular, we recognize the risk to production facilities from serious storm and flood damage at our key hubs in Japan and overseas.

Although the magnitude of these risks may vary, the Asahi Kasei Group recognizes that all of them could materialize as climate change progresses and will continue working to mitigate such risks.

| Risks | |||

| Important Changes | Main Risks | Principal initiatives | |

| +1.5°C scenario | Transition to a carbon neutral society | ・Cost increases due to more stringent regulations (manufacturing, raw material)

・Changes in materials needs (carbon neutral needs, required specifications)

|

Promoting action toward carbon neutrality ・Expansion in utilization of renewable energy, etc. ・High efficiency in energy use, development and commercialization of innovative industrial processes ・Utilization of biomass raw materials ・Accelerating products’ carbon neutrality by understanding their carbon footprint of products ・Reviewing allocation of management resources (including business portfolio transformation) |

|---|---|---|---|

| Changes in market structures | ・Contraction of existing markets due to transition to a circular economy

・Contraction of existing markets due to the advance of alternative technologies

|

・Development of material/chemical recycling technologies and furthering their rollout in society ・Utilization of biomass raw materials ・Reviewing allocation of management resources (including business portfolio transformation) |

|

| +4°C scenario | Serious storm and flood damage | "Physical" production risks ・Damage to factories causing suspension of production ・Raw material supply chains disrupted by disasters affecting suppliers

|

・Continuous revision of BCP and reinforcement of preemptive response (review inventory levels, consider switching to multiple suppliers/locations, etc.) |

| Rise in temperature | "Human" production risks ・Deterioration of working environment and productivity at construction sites

|

・Measures to prevent heatstroke at construction sites ・Measures to industrialize and utilize IT in home construction |

|

- 10Asahi Kasei Group GHG emissions in 2024 (Scope 1 and 2 preliminary figures): 3.19 million t-CO2e. When the carbon cost is set at ¥15,000/t-CO2, with reference to the CO2 price level in 2030 by NZE scenario of WEO 2024,etc.

Risk management

The Asahi Kasei Group places strong emphasis on managing both the opportunities and risks associated with climate change.

GHG emissions monitoring

For Scope 1, 2, and major categories of Scope 3, the Asahi Kasei Group annually tracks GHG emissions performance figures with third-party assurance. Progress toward targets is shared within the Carbon Neutrality Project, where future initiatives are discussed and reviewed.

In addition, during the formulation and annual review of the Medium-term Management Plan, we confirm the status of initiatives to reduce GHG emissions and incorporate the findings into our business strategies and measures.

Internal carbon pricing (ICP)

When making capital investments, we evaluate profitability by incorporating ICP into our assessments and use the results in our investment decisions. We set ICP prices while taking into account carbon and market prices projected by the International Energy Agency (IEA), as well as the Asahi Kasei Group’s own cost projections for carbon neutrality.

Indicators and goals

The Asahi Kasei Group considers the following indicators to be related to climate change opportunities and risks.

| Targets and results | Meaning of indicator | |

|---|---|---|

| GHG emissions14 |

| Indicates Scope 1 and 2 reductions |

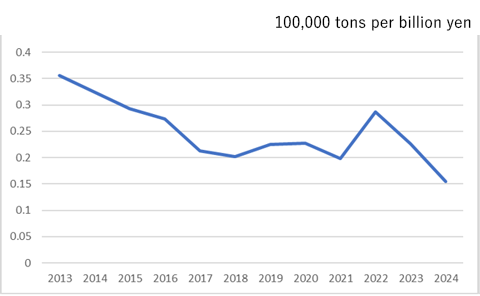

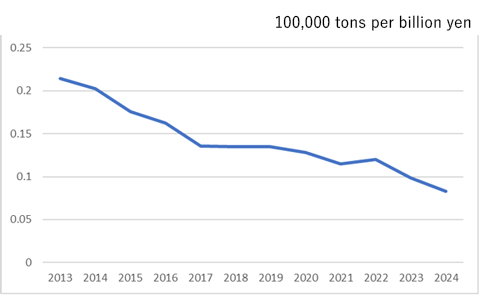

| GHG emissions14/operating income |

| Decrease indicates reduced carbon tax risk |

| ROIC |

| Increase indicates evolution into a highly profitable entity resilient to change |

Other related matters

| Internal carbon pricing | ¥15,000/t-CO2, utilized in our investment decision-making, awards program, etc. |

|---|---|

| Incorporation of climate change issues into directors’ remuneration | Monetary performance-linked compensation, which accounts for 30% of directors’ remuneration, is based on a combination of achievement levels for financial targets and non-financial targets, including sustainability promotion (such as GHG emissions reduction) |

- 14GHG emissions cover Scope 1 and Scope 2. The calculation covers seven types of GHGs: carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulfur hexafluoride (SF6), and nitrogen trifluoride (NF3).

We have also set a goal to more than double by fiscal 2030 and increase by 2.5 times by fiscal 2035, compared to fiscal 2020 levels, the GHG emission reduction contribution of our products and services (Environmental Contribution Products) that help reduce society’s GHG emissions across the entire value chain.

GHG emissions / operating income [2013–2024]

GHG emissions / operating income [2013–2024] GHG emissions / (operating income + depreciation and amortization, including amortization of goodwill) [2013–2024]

GHG emissions / (operating income + depreciation and amortization, including amortization of goodwill) [2013–2024]